Data analysis: The looming US gas giant

A massive build-out of new gas-fired power plants is underway in the PJM market as power producers seek to take advantage of cheap natural gas from the Marcellus shale formation.

Over the next five years, ratings agency Moody’s estimates that 100TWh of new high-efficiency gas plants will come to market to provide on-peak power, effectively growing supply by 25% over 2015 numbers at a time when demand growth has been negligible.

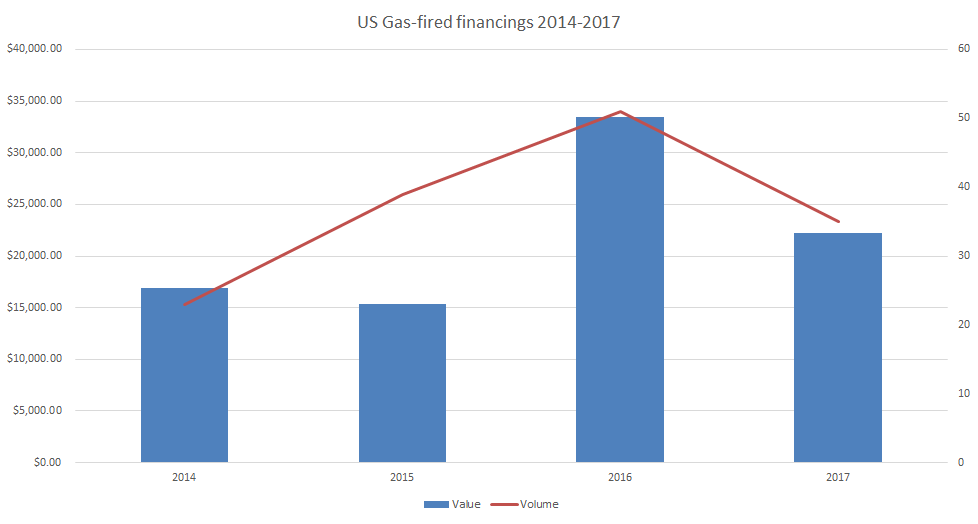

Data from IJGlobal shows financings in the gas-fired sector have indeed already risen sharply in 2016 and 2017 (H1) over previous years as gas-fired generation gains favor due to its ability to both reduce carbon pollution, as compared to coal-fired baseload, and to provide steady power load to balance power coming from renewables.

Market conversion

As new gas-fired assets come online, coal is expected to take the biggest hit. Unless coal-fired owners such as Talen, FirstEnergy, Dynegy and GenOn – which is in the midst of a restructuring – are able to de-lever their balance sheets, downgrades are expected.

As a direct result of the glut of new power plants coming to market, power prices in the PJM are expected to fall by $7 per MWh at peak times and $3.5 per MWh round the clock—15% and 10% declines, respectively, according to a Moody's May 2017 report. This will be challenging for all fossil fuel generators, but owners of aging inefficient oil and gas, coal and even nuclear generation are expected to suffer the most.

Since 2010, 253 US coal-fired power plants have been retired and roughly 270 remain, according to the Sierra Club. Even as President Donald Trump is set to announce withdrawal from the Paris Climate Accords, three coal plants closed on 1 June 2017 – the Mercer and Hudson generating stations in New Jersey and the Brayton Point Power Station in Massachusetts – signaling that political will is no match for the troubled economics of running coal plants in a cheap gas environment.

Nukes in need

Nuclear generation fleets are also struggling to compete. After Three Mile Island failed to make the cut in the latest capacity auction for 2020/21 where prices came in at $76.53 per MW-day, Exelon has announced plans to shutter the storied Pennsylvania facility in 2019. The company said that absent regulatory intervention that recognises the zero-carbon attributes of nuclear power such as New York’s clean energy standard and similar programming in Ohio, nuclear generation can no longer compete with the low prices available from gas-fired generation.

The real struggle for coal, nuclear and aging inefficient gas generators is just on the horizon, according to Moody’s analyst Toby Shea. Just as a mass of new high-efficiency gas plants are set to hit the market, older operating plants are likely to be seeking to refinance, putting their needs for capital directly into competition for debt from the same banks that could be more interested in putting money into newer, more economic plants.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.