UK pension funds dip into water utilities

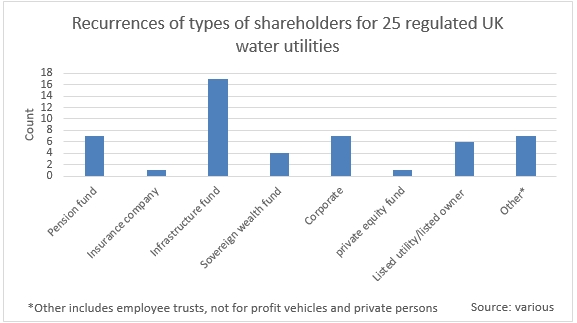

Following privatisation in 1989 the UK water sector has been through a few cycles of acquisition. Today the shares of regulated utilities sit predominantly in the coffers of infrastructure funds. Of the 25 water utilities in England and Wales regulated by Ofwat, there are 17 instances of an infrastructure fund being among the shareholder consortium, or the sole shareholder.

The infrastructure fund managers publicly known to hold shares include: 3i, iCON Infrastructure Partners, Colonial First State, IFM Investors, Brookfield, KKR Infrastructure, Hermes Investment Management, JP Morgan Asset Management, Cheung Kong Infrastructure, UBS Asset Management and Deutsche Asset Management.

The infrastructure fund managers publicly known to hold shares include: 3i, iCON Infrastructure Partners, Colonial First State, IFM Investors, Brookfield, KKR Infrastructure, Hermes Investment Management, JP Morgan Asset Management, Cheung Kong Infrastructure, UBS Asset Management and Deutsche Asset Management.

This month Morgan Stanley Infrastructure Partners, Infracapital and Veolia completed the sale of Affinity Water to HICL Infrastructure, DIF Infrastructure IV and Allianz Capital Partners (who invested on behalf of the Allianz Group insurance company). Notably this is the first time these investors have acquired an operational UK water utility. DIF and HICL have historically been primarily PPP investors.

HICL has made a debt investment in a water company before, however. It provided a loan to Macquarie when it bought Thames Water. As IJGlobal reported from an interview with InfraRed’s Harry Seekings, while regulated assets were already part of HICL’s investment strategy, it is in the last 18 months to two years that HICL attained what it regards as the critical mass necessary to be able to make an acquisition of this size without upsetting the portfolio’s diversification. HICL’s 36.6% share came to £269 million.

DIF has also invested in regulated utilities before. It recently acquired a stake in gas utility Thyssengas in Germany and the Thames Tideway Tunnel construction project in the UK in 2015.

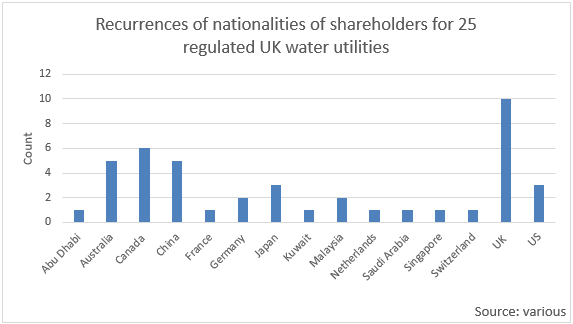

After infrastructure funds, pension funds and corporations appear next most frequently as shareholders of UK regulated water utilities. The known pension funds that are direct shareholders are all Canadian and Australian with the exception of only one from the UK: BT Pension Scheme which has a Thames Water stake.

Canadians are the most prevalent shareholders after UK investors, appearing six times among the current shareholders of UK water utilities, followed by Australian and Chinese investors.

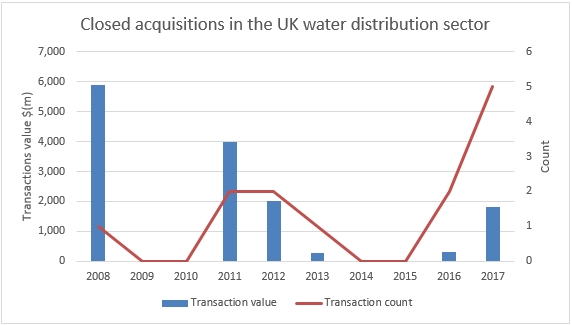

For the private shareholders 2017 was a particularly busy year in term of acquisitions. Five transactions have completed in 2017 to date, according to IJGlobal data, which is the largest amount since 2008 when Yorkshire Water was taken private. The regulatory period for water utilities runs for five years, and the current price control period AMP6 is for 2015-2020. Midway through a cycle, as 2017 is, is a typical time for transactions as for a prospective buyer there is visibility for the existing period and the ability to engage in the review for the price determination one year before the next period.

Further UK pension money is due to enter the sector this month when HICL will sell £25 million of its equity in Affinity Water to a small group of UK local authority pension funds acting as co-investors.

However there is a threat to private sector ownership of water utilities altogether. In Labour’s manifesto for the upcoming general election on 8 June, the party states that “annual bills in the water sector have risen 40% since privatisation” and says Labour will “replace our dysfunctional water system with a network of regional publicly-owned water companies”, as part of a broader renationalisation policy spanning energy, rail and the Royal Mail. The Green Party have a similar policy to take public “energy, water, railways, buses, the Royal Mail and care work”.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.