PPP, transport and the need for diversity

The UK government has promised a new pipeline of PF2 projects by the spring. Naturally these things are often delayed. While the infrastructure market waits the hope is that the list of projects will include more than just transport.

While UK infrastructure PPP deals have, for most of the history of the PPP sector, been evenly distributed across a number of subsectors, in continental Europe the majority of deals are focused on transport.

As a result when the numbers of UK PFI/PF2 transactions fell to a trickle, this left little activity elsewhere in Europe beyond the transport sector.

In fact, IJGlobal data reveals that this year all infrastructure PPPs to reach financial close or complete a refinancing in Europe were transport deals.

While investors wait for the UK’s PF2 pipeline they are still faced with a fairly limited number of European PPP deals to invest in and a lack of variety in terms of infrastructure subsectors they can choose.

“In Germany, Holland, and the Benelux countries there’s a good pipeline, but these economies have not created the same level of pipeline as the UK had historically,” said EY's head of transport infrastructure, Manish Gupta. “If you look at social infrastructure, education, and health, most of these countries continue to invest heavily through the public sector. In contrast, the UK had previously employed a model where it was private sector delivery and financing of infrastructure and public sector services. Of course, this situation has now changed in the UK,” he explained.

Which points to a less mature PPP sector in need of further development and greater diversification on the continent.

UK

In the UK, there have been years (2012-2015) when transport transactions represented a very large proportion of the value of all infrastructure PPPs closed (on average 63%). However, during the 2002-2011 period, transport deals accounted for an average of only 13% of the value of infrastructure deals to close in the UK. And 2016-2017 has also seen a shift away from transport deals, with only 8% of the value of last years closed deals coming from transport-related transactions, and no transactions of this type closing this year to date.

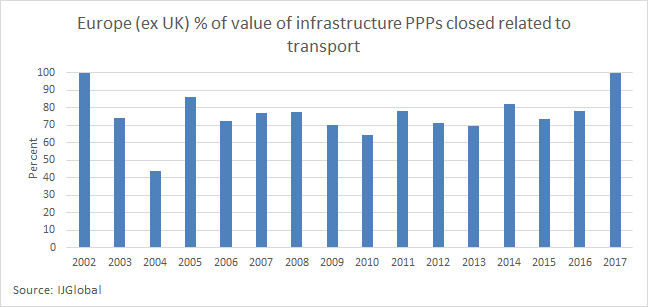

Europe

In contrast, the value of transport PPPs closed in continental Europe has averaged 76% compared to the total value of all infrastructure transactions to reach financial close from 2002 to 2017.

The problem is that the PPP model has run into “cultural resistance”, especially over recent years, with the border between public and private still “deeply ingrained in the national psyche—particularly with social infrastructure projects,” said François Bergere, program manager of the Public Private Infrastructure Advisory Facility within the World Bank Group. “Today, the program has significantly decreased due to a combination of budgetary sustainability issues, political reassessment, and what some say is ‘PPP bashing’ in the media."

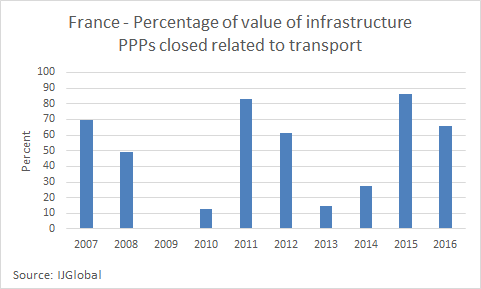

His comments are about the French PPP programme particularly, but they could easily apply to a number of European countries.

France’s numbers provide an interesting analysis. In 2005, 93% of the value of infrastructure PPP deals closed were transport-related, greater diversification between sub-sectors pushed that figure down to an average of 21% in 2013-14, helped by the PPP division created by the Ministry of the Economy in 2004 which drove significant development of the sector for some 10 years. During that time, deals were closed in a number of infrastructure sub-sectors in the country, including healthcare, water, and government office buildings, but with a particular focus on facilities that serve the education and justice systems (prisons and courthouses). However, since then, with the tide of public opinion and political favour turning the other way, the proportion of the value of infrastructure deals closed related to transport projects shot up again, reaching 87% in 2015 and 66% last year.

Ultimately, with the mainstream media and much of the public at large still convinced the PPP model offers little value for money to the taxpayer, a large part of what’s needed to achieve greater diversity of subsectors and maturity for the PPP sector is to educate all parties involved and the public as to the benefits of transferring risk to private companies.

And while political support for the PPP model has wavered, with parties in a number of countries preferring to count on the lower cost of financing that can be achieved through state balance sheets, competing demands on public coffers and constrains on public debt will continue to make it difficult for the state to finance infrastructure projects.

Smaller deals

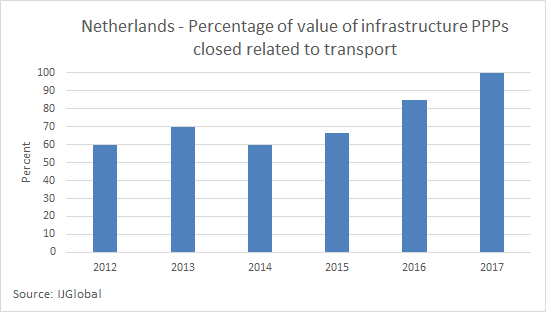

Meanwhile, even in European countries where larger numbers of non-transport infrastructure deals have closed, a closer analysis reveals that in terms of value these transactions are eclipsed by transport-sector deals.

For example, in the Netherlands, although IJGlobal data reveals that only 19 transport PPPs have closed since 2003, the value of each of these transactions is such that since 2012 they have accounted for on average 73% of the value of all infrastructure deals closed in the country.

In Germany, the situation is much the same, with only 13 transport deals closing in the last 10 years, mainly roads, but with values that are far above those of any other type of project.

And with only smaller non-transport infrastructure projects being developed via the PPP model in Europe, many of them also fail to attract much attention from international banks and investors, which means opportunities for lowering financing costs are also lost.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.