Financing Argentina’s ambitious infra plans

Protesters took to the streets of Argentina's capital city Buenos Aires in March, in objection to government austerity measures and President Mauricio Macri plans to open up the Argentine economy to foreign investment. Macri wants to boost economic growth in the country, and increased spending on infrastructure is central to his plans.

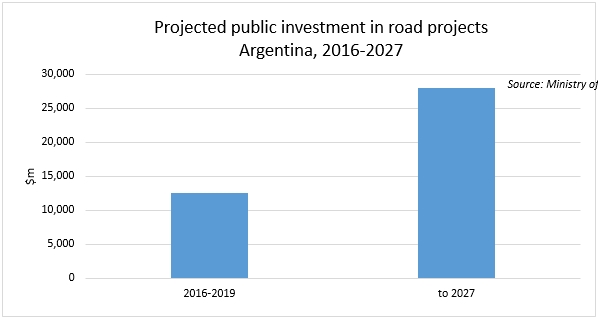

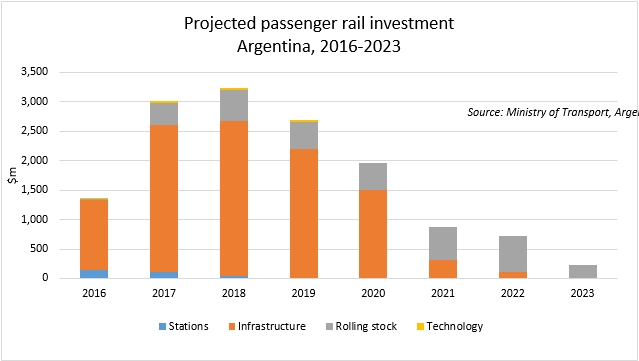

Infrastructure has been allocated a quarter of the government’s spending until 2019, including $33 billion of public funding for transport projects.

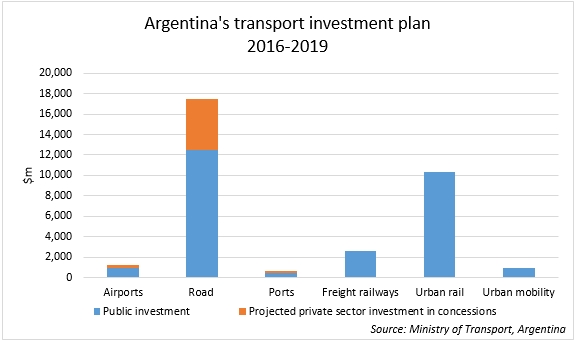

Argentina’s transport infrastructure plan includes investment in roads, freight rail, regional railways, urban rail projects, urban mobility, waterways and ports and airports. The majority of public spending is allocated to road and urban rail development.

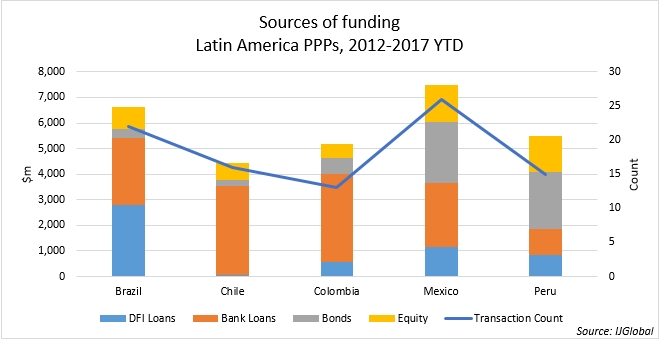

The government is seeking significant private sector investment to support its ambitious plans, and so must attract foreign capital. A PPP law was introduced in December 2016 and many of the projects in the pipeline are expected to be procured as PPPs. Many international companies working in the region had expected a plan reliant on multilateral financing to bring projects to close. While that model is plausible for a handful of projects, for a large scale programme it is not the optimal solution.

Argentina’s PPP law is more of a framework than a detailed law however, a consequence of Marci’s limited control of congress. Supporting regulation was released in February 2017 to provide more detail but many have criticised the regulation for its lack of thoroughness. The regulation nonetheless provides the building blocks for the government to procure projects as PPPs.

Luis Molouny, national director of economic management, Ministry of Transport, Argentina told IJGlobal that there was a huge need for investment in transport infrastructure in the country. He said: “The aim is to create sustainable transport infrastructure in Argentina, improve the safety of our transport infrastructure and improve connectivity across the country. We will procure projects as PPPs and we expect to release the first PPP projects in the very near future.”

However the first projects in the Ministry of Transport’s infrastructure plan will come to market under Argentina’s existing public works laws, and multilateral financing will likely play a large role. A PPP project is not expected to come to market before the end of 2017 or early 2018. That is when the government hopes to see international financiers on projects.

International capital markets

What project sponsors will need is the ability to access the international capital markets. Argentina is not yet investment grade and it is difficult to predict how long it will be before it is. It is unlikely sponsors will be able to find international lenders willing to take on sub-investment grade paper. There is limited liquidity in the local market. Argentine local banks offer debt on a three-year tenor on average and Argentina has just one national pension fund – ANSES.

A number of international banks that have invested elsewhere in the region, Goldman Sachs, UBS and BNP Paribas to name a few, are already understood to be looking at opportunities in Argentina. And all of them are looking at capital market structures.

Of the most active PPP markets in the region, Peru and Mexico have been the most active when it comes to capital markets financing, according to IJGlobal data.

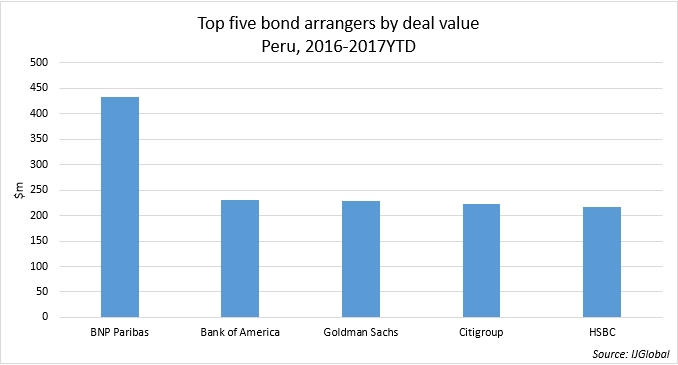

International bond houses dominate in Peru. BNP acted on the highest value of bond deals since January 2016 in the country, according to IJGlobal data.

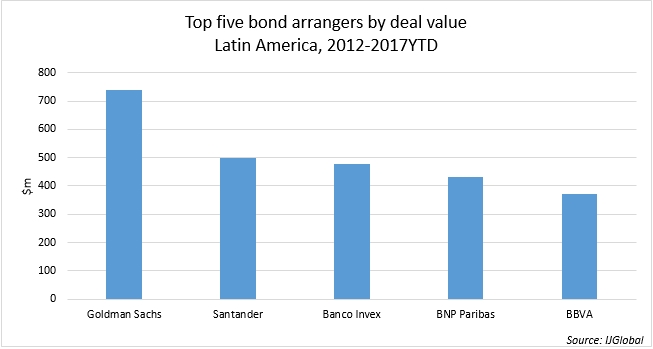

Across Latin America, Goldman Sachs and Santander have dominated the bond markets for infrastructure assets in the last five years. They are joined in the top five bond houses by other Europeans. Mexico’s Banco Invex also features due to its presence as a bond arranger on most Mexican deals.

Gianluca Bacchiocchi, a partner in Clifford Chance's Americas energy & infrastructure group, whose firm was one of the advisers to the Argentine government, believes the Peruvian model will most likely play a role in how projects are structured in Argentina. Peru has been very successful in attracting international investors. Most of the big projects in Peru involve capital market transactions and international banks.

Bacchiocchi said: “Peru has been successful in attracting international investors for its projects due to the milestone payment structure and because most projects have a dollarized component.

“We are trying to introduce the milestone payment model in Argentina and have advised the government that the PPP law should allow for these financial structures. It would make sponsors more comfortable.”

The procurement structure used in Peru allows for payment obligations that are there to purely compensate the sponsor for works already completed. These milestone payments mitigate the risk associated with projects that fail to reach construction completion for reasons beyond the sponsor’s control.

The Argentine government will need to make sure that any large projects in the pipeline are dollar denominated in order to attract international financing.

Bacchiocchi said: “Local banks are the only ones that will do Peso deals. There are no international banks that will do longer-term swaps for a Peso deal. I doubt multilaterals would even touch Pesos right now.”

European sponsors

Once the projects come to market there is likely to be significant interest from European sponsors, who have experience developing projects in the country. Bacchiocchi said he expects to see the likes of ACS Group and Salini-Impregilo bidding on deals.

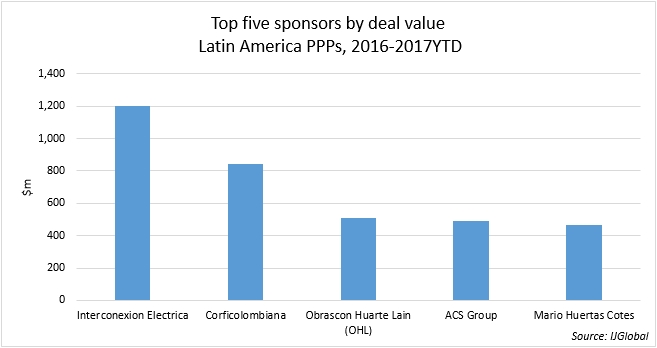

According to IJGlobal data, Spanish construction firms OHL and ACS were both in the top five sponsors, in terms of deal value, in Latin America for PPP deals closed since January 2016. The remainder are Colombian firms, a consequence of Colombia’s successful 4G roads programme. Despite the lack of infrastructure development in Argentina there are still some large Argentine companies – Technit, Iecsa and Roggio – that will also be interested in bidding for projects.

Molouny said the Ministry of Transport expects to see international investors come and invest in Argentina due to the scale of projects in its pipeline. He added that his ministry would set out indicators and objectives for project development and would act as a blueprint for other government departments.

The question remains, is Argentina’s PPP law robust enough to attract international finance for its ambitious transport plans? It will be some time before we can answer that.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.