The road to India

IJGlobal revealed this week that fund giant Morgan Stanley Infrastructure Partners will launch a new Indian infrastructure fund.

It’s an interesting move. Investors have shied away from the country in the past due to strict foreign investment rules, circular debt concerns on power projects and the opaqueness of the market. But in a low interest rate environment investors are searching for yield in emerging markets.

And in India there is opportunity aplenty. Indian prime minster Narendra Modi announced in February a $59 billion stimulus for roads, rail and airports.

The new fund from MSIP will invest in companies and projects in the transport sector, as well as power and renewables, and will take small stakes in projects.

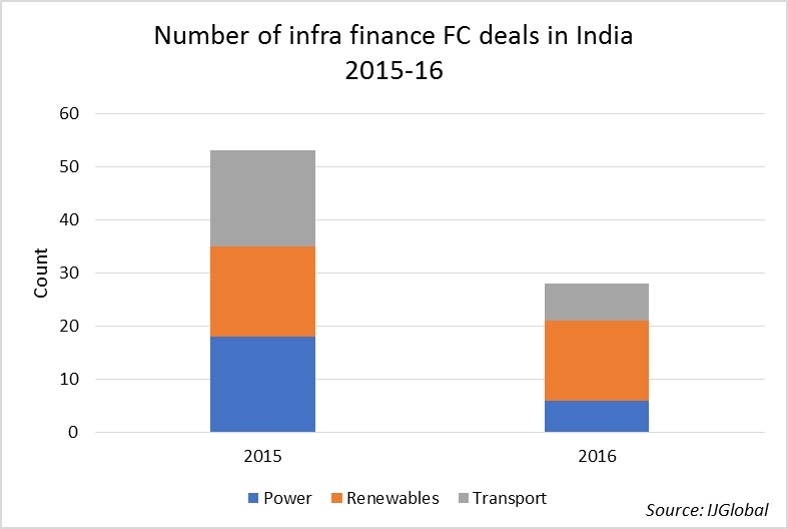

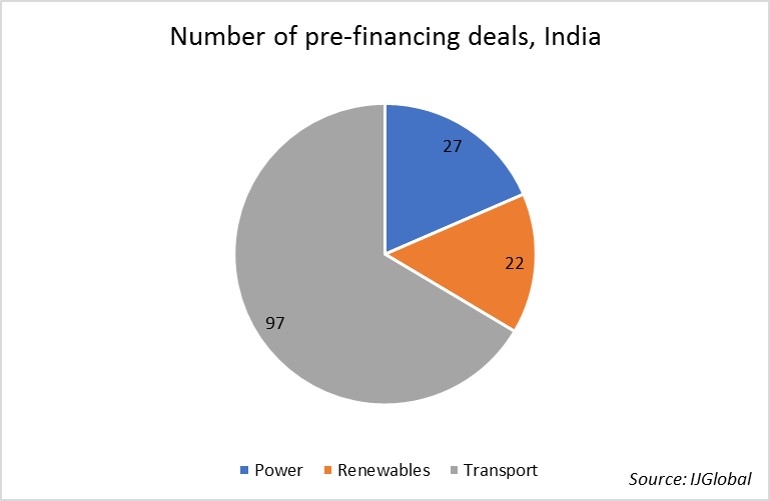

According to IJGlobal data a total of 81 deals have reached financial closed since January 2015 in the sectors the fund is targeting, and a further 146 deals are in the pre-financing stage. There is a substantial pipeline of projects in the transport sector and MSIP has experience investing here. MSIP has invested in four Indian assets in its previous funds; a road bridge, two wind farms, and a hydro asset.

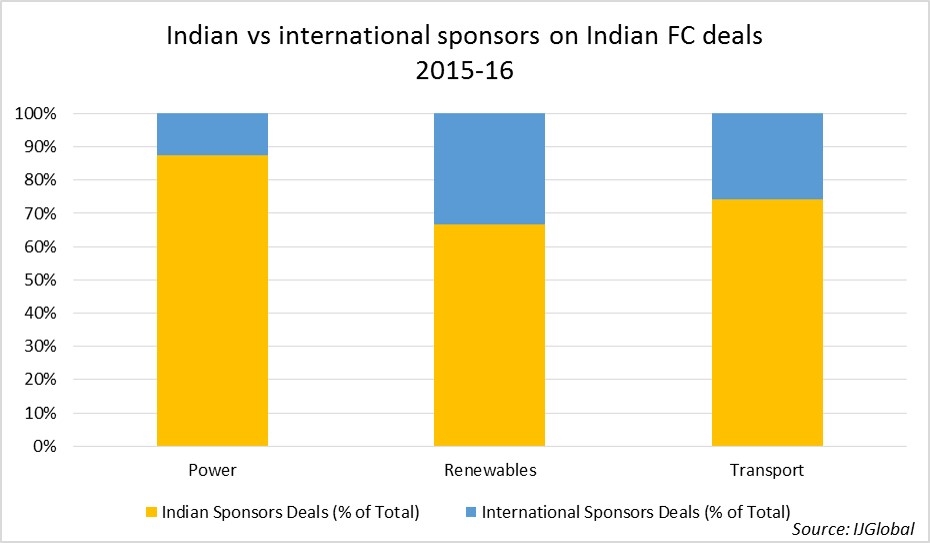

The government appears to be pushing for private sector involvement in developing this new infrastructure. Modi’s government said in its 2017-18 budget that it will build airports in smaller cities in India in partnership with private companies. But international private sector finance is not the norm for Indian infrastructure.

Of all deals closed in the last two years in the transport, power and water sectors in India the sponsor consortia have been dominated by Indian investors, according to IJGlobal data. As the pipeline of projects in the country grows, and projects become more complex, private sector partners, both international and local, will be required to get projects shovel ready.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.