“Standard Aberdeen” and UK infrastructure

Standard Life this week announced a £3.8 billion takeover deal of rival asset management firm Aberdeen Asset Management. Many have claimed that this is the start of much needed consolidation in the asset management industry. But what does it mean for the pair’s infrastructure activities?

Alternatives investment and infrastructure particularly is a relatively small part of the firms’ overall investment portfolios.

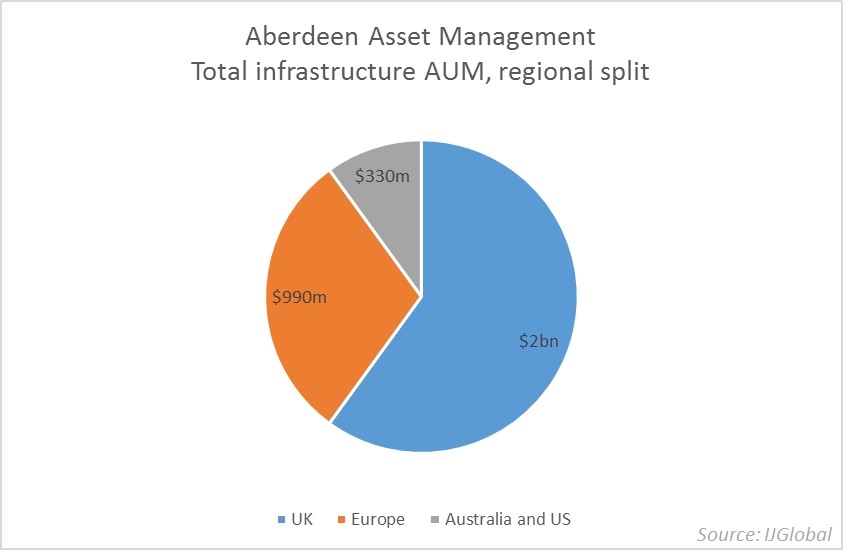

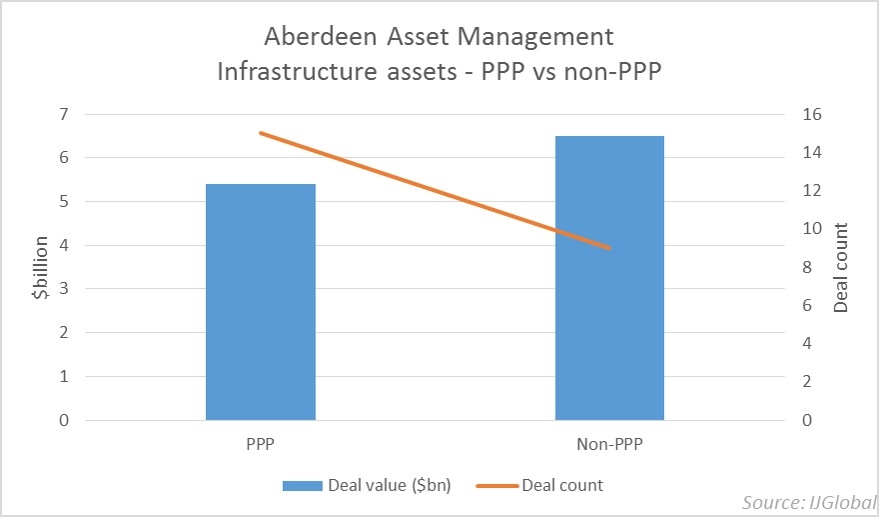

For Aberdeen, alternatives accounts for just 7.4% of its overall investments. It built out its infrastructure investment division when it bought Scottish Widows Infrastructure Partners in 2013, and with it it’s four infrastructure funds. It launched a new fund under the new Aberdeen Infrastructure Funds in 2014. It now has $3.3 billion of funds under management across seven unlisted funds and associated vehicles.

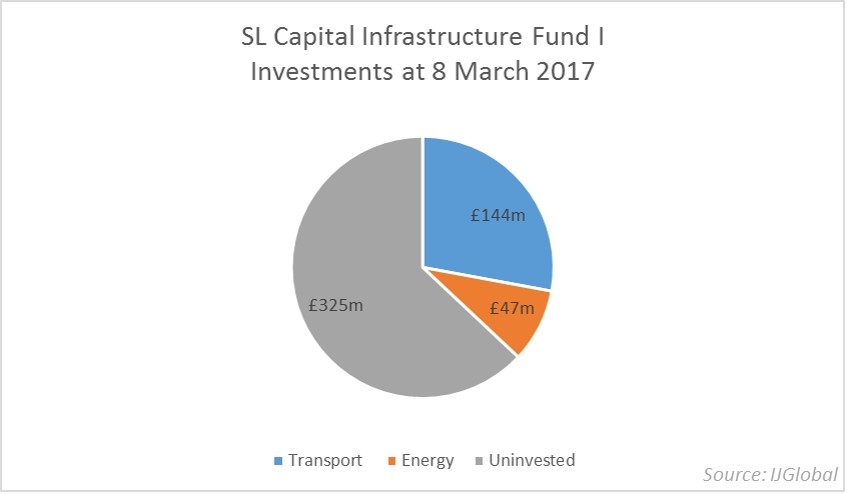

Meanwhile Standard Life, through its private equity arm SL Capital, closed its first infrastructure fund just last month. The fund has invested 37% of its capital already. Both fund managers have favoured investments in their home market. Aberdeen Infrastructure Funds has invested 60% of its investment capital in the UK projects. SL Capital Infrastructure Fund I has invested $144 million in UK rail projects to date, over half of the £191 million it has already invested.

The two firms together would certainly be a force in the UK market. Those at the firm are understood to be excited about the potential scale of what they’re calling “Standard Aberdeen”. However given the limited pipeline for investment in the UK the pair will likely have to set their sights further afield to remain competitive.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.