Data Analysis: Car parking companies - future risks, or opportunities

Roughly three years after buying French car parking business Indigo, long-term investors Ardian and Predica are already reviewing a full or partial sale. The rationale: that new blood is needed for Indigo to achieve real growth in Asia and consolidation in Europe, IJGlobal has reported. With another multi-billion sale of European car parking giant Q-Park further advanced, infrastructure and private equity investors bidding for these businesses will be considering game-changing shifts in the industry perhaps not so far away.

Funds circling

The three largest parking companies in Europe are Indigo, Q-Park and Apcoa.

In early February 2017, various international financial investors submitted indicative offers to buy 100% of Netherlands-based parking operator Q-Park, which sources say could fetch as much as 10x to15x its earnings before interest, tax, depreciation and amortisation (EBITDA). That would be approaching €2 billion ($2.11 billion) in terms of enterprise valuation. The shareholders selling are a long-list, primarily of Benelux pension funds.

Bidders include: US private equity manager KKR, which has a stake in operator Saba; Australian fund manager Macquarie, a former owner of the UK’s parking operator NCP; and, Hong-Kong listed infrastructure investor CKI, which owns airport parking company Park’n Fly in Canada.

With Q-Park’s sale far advanced, Ardian and Predica are likely to want for their own anticipated sale of Indigo to entice those experienced candidates and other infrastructure funds attracted to the sector. One source told IJGlobal they expect a sale of Indigo to launch in mid-March.

Valuation forecasts for Indigo are coming in as high as 13x EBITDA, though some would put it closer to 10x as limitations include the Paris mayor’s policy unveiled in January 2017 to reduce by half volumes of private cars entering the centre. Around 40% of Indigo’s earnings comes from Paris. Under the higher multiple, Indigo could be valued at around €4 billion.

Germany-based Apcoa has been owned by creditors, including majority shareholder hedge fund Centerbridge Partners since January 2015, which makes it a possible sale candidate, and it is in the process of refinancing, raising €325 million seven-year debt, according to a Moody’s credit opinion dated 3 March 2017.

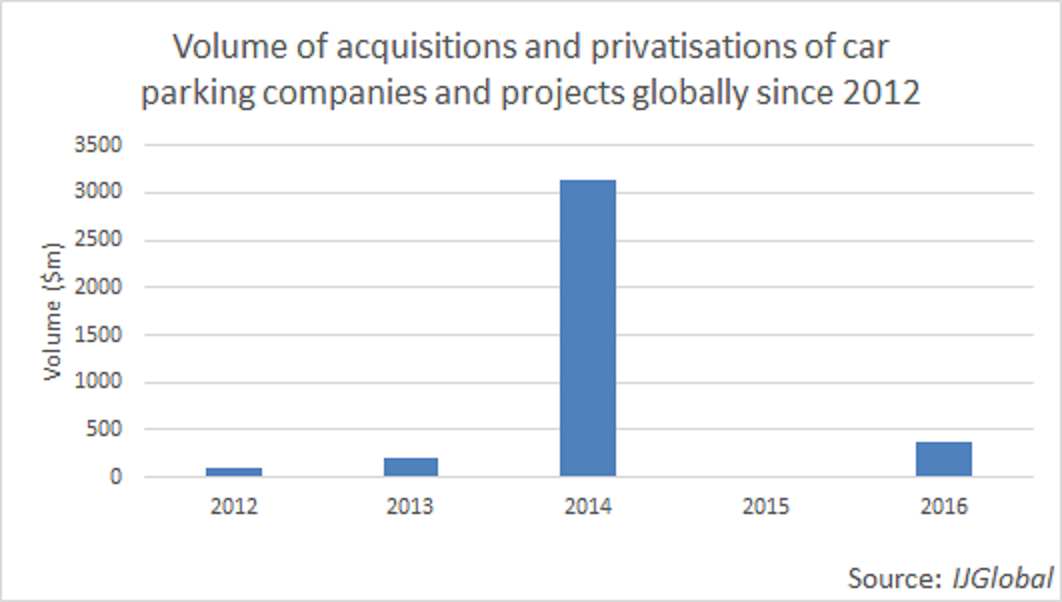

During 2015 a sale of Iberian operator Empark to Indigo was in advanced negotiations but the shareholders called it off. The acquisition of 75% of Indigo, then named Vinci Park, in 2014 valued the company at €1.96 billion in the last major European operator sale. 2017 looks likely to be a year in which M&A deal volumes for car parking companies would surpass 2014.

A heterogeneous industry

Carparking companies can own carparks, or hold long-term concessions with municipalities under which often the tariff framework is typically pegged to inflation, or manage carparks under short term management contracts, typically in the region of three to five years in duration and often with private companies or local authorities. Companies often include a combination.

“Q-Park is probably more attractive for private equity investors, because the business model {comprises} more operating leases, and private operating leases with shorter durations around 6-7 years, rather than classic long term concession contracts and predictable long term cash flows,” says Freshfields Bruckhaus Deringer partner Pascal Cuche. Indigo on the other hand has primarily long-term concessions with the public sector and should attract more infrastructure investors, he adds.

However Indigo’s recent expansion in international markets is taking it increasingly into shorter term contracts. Indigo has particularly grown in South America, North America since Ardian and Predica’s acquisition.

Domestic European business

As Indigo is looking to Asia, especially the large market in China, as a next geographical challenge, the outlook for growth in Europe is more benign and the emphasis for businesses is on obtaining contract renewals.

Pieter Rommens, vice-president senior analyst at Moody’s corporate finance group, says, “There is a slow but steady trend for municipalities to increasingly outsource the parking that they own under lease or management contracts…. In the Scandinavian countries and the UK there are the highest levels of parking outsourced, between 60-80%. In Apcoa’s second largest markets, Italy and Germany, less than 50% is, so arguably there is room for growth there.”

Long-term prospects

But there are potentially bigger waves that could reshape the parking sector coming, though how far off is conjecture.

Joanna Fic, a vice-president – senior credit officer at Moody’s infrastructure finance group, says, “There is a long-term question regarding the need for car parks in certain locations. That can be driven by trends such as technology, electric vehicles, car-sharing, or congestion and air pollution in city centres and what that means for traffic being allowed. I think we’re at early stages of that route… but these are some risks, and opportunities.”

In June last year, IHS Automotive forecast sales of 600,000 autonomous cars globally in 2025, and 21 million per year by 2035. Driverless cars are a disruptor getting nearer as test-drives spell progress, but it is speculation for now that people might travel around in these with no need to park.

In the US, AMP Capital became a shareholder of the downtown parking concession holder in Chicago, Millennium Garages, in 2016.

To stay ahead of game-changing developments, AMP Capital’s global head of infrastructure equity Boe Pahari points to future potential alternative uses for the city-centre underground space Millennium Garages owns. For example online retailers could create warehousing in the city centre to aid their “last mile” stage of deliveries, and the cool secure spaces located near offices could be ideal to host data centres.

In the meantime technology, such as electric charging stations and apps to allow pre-booking and locating spaces including for private parking, is being deployed by Indigo with its digital platform OPnGo, are a way to stay ahead of competitors. Portfolio growth via acquisitions offers companies ever greater customer data collection potential, which can be mined to tailor pricing, create synergies in the portfolio and ultimately maximise yield.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.