Will PPP solve Asia’s infra need?

The need for infrastructure in developing Asia Pacific is now estimated to be between $1.5-$1.7 trillion a year to 2030. A new report published by the Asian Development Bank this week highlighted the demand for infrastructure investment in the region far exceeds the pace of development. This new figure is almost double what the ADB estimated in 2009 – a mere $750 billion per year in comparison.

The development bank has lauded the benefits of PPP as a model to attract more private capital to the region and generate a pipeline of bankable deals. But can PPP really be the answer to Asia’s infrastructure needs?

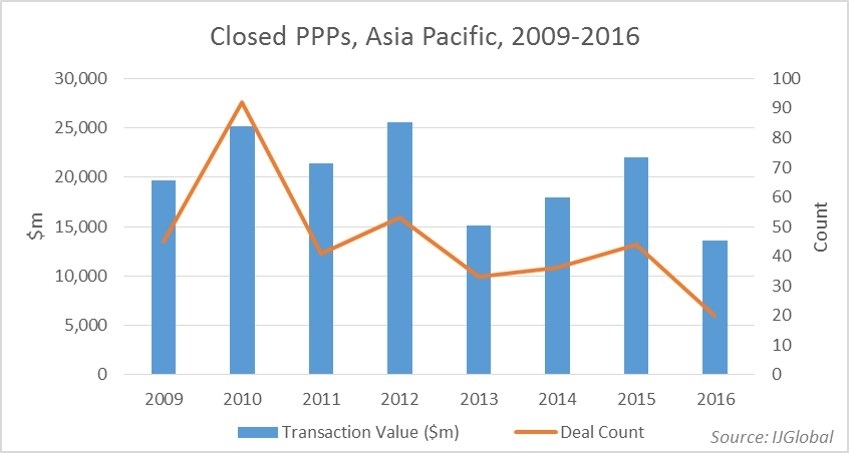

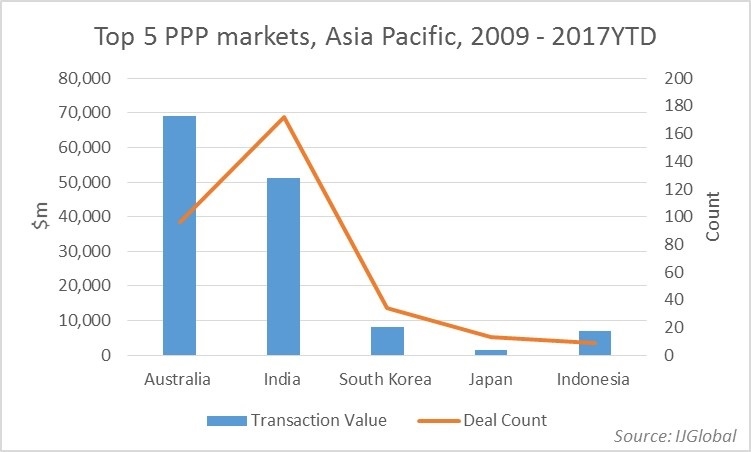

According to IJGlobal data just 364 PPP deals closed in Asia Pacific between 2009 (the date the last forecast was made by the ADB) and 2016. The total value of those PPP deals was $160 billion, and most of those were in Australia, one of the most developed PPP markets in the world.

The increased demand for infrastructure spend in Asia Pacific comes as a result of faster economic growth and the shift towards climate change mitigation and green energy. In its report the ADB said that investment was needed particularly in the power, transport, telecoms and water sectors. At least $14.7 trillion will need to be spent on power infrastructure in the region up to 2030, according to the report and a further $8.4 trillion on transport infrastructure.

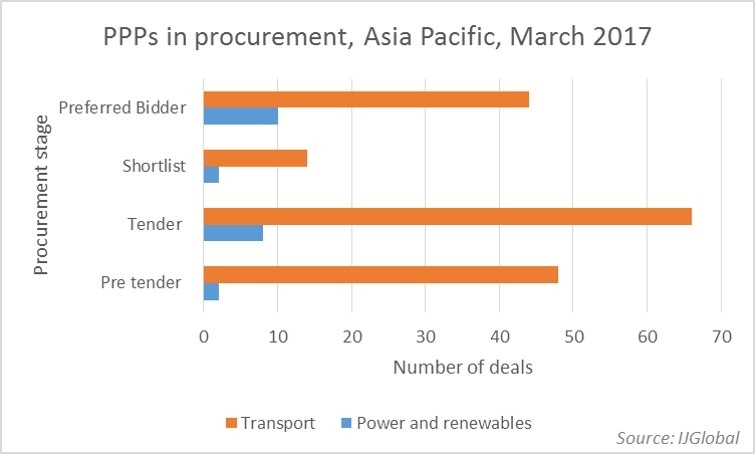

Transport infrastructure has been one of the biggest beneficiaries of the PPP model in the region. According to IJGlobal data, 221 transport PPPs closed in Asia Pacific between 2009 and 2016, with a total value of $101 billion. Meanwhile power and renewables has lagged behind with just 32 power and renewables PPPs closed, with a total value of $18 billion, in the same time period. However those transactions account for just 4% of all power and renewables transactions with private sector financing closed between 2009 and 2016.

PPP is often not the model used to harness private sector capital for the development of energy projects. Can PPP become the preferential model for energy development in the region? If countries are to meet the forecasts set out by the ADB the drive will need to come from the public sector, so perhaps it will have to.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.