French broadband roll out speeds up

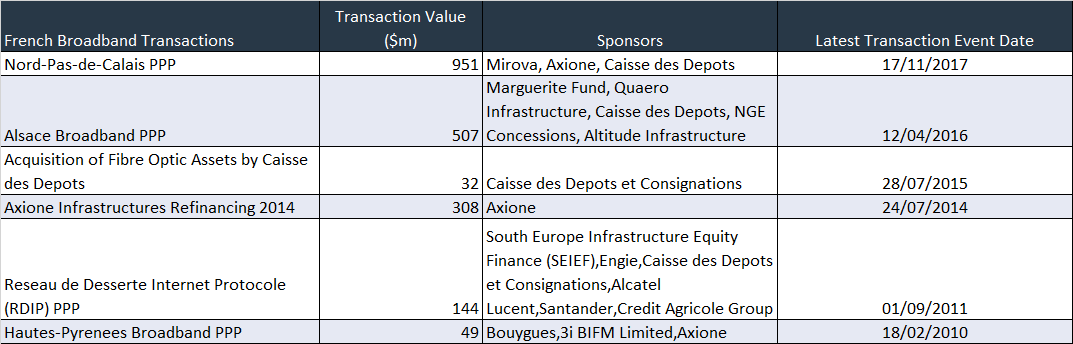

Last year saw France’s first two large-scale high-speed broadband network greenfield projects, the Alsace and the Nord-Pas-de-Calais PPPs, reached financial close.

The projects are part of the country’s Ultra-Fast Broadband Plan, which was launched in 2012 and aims to roll out ultra-fast internet connections across the entire country by 2022.

Now first offers are expected at the end of March for the country’s largest broadband PPP to date, known as Grand Est, which will be worth an estimated €1 billion ($1.05 billion).

Meanwhile, a number of smaller projects have also been completed, with others underway or expected to come.

For now, investors in these projects have been almost exclusively French, but international lenders are starting to show interest, sources say.

Ultra-Fast Broadband Plan

France’s Plan Très Haut Debit, as the country’s broadband programme is known, is expected to lead to €20 billion of public and private funding in fibre optic networks. It will provide a faster alternative to the existing copper ADSL digital infrastructure. However, to achieve this, different parts of the country require different approaches.

For very dense population areas in and around cities, telecom operators are willing to invest in their own infrastructure. In these places, which correspond to about 20% of France’s population and around 150 cities, a number of operators are building networks that will compete to provide services to end users.

For the remaining parts of the country, in 2011 the French state and digital communication regulator ARCEP launched a call for expressions of interest from operators to roll out ultra-high-speed digital infrastructure outside densely populated areas. As a result of this, France Télécom-Orange and SFR signed a co-investment contract in November that year in which they committed to rolling out a shared network in about 3,500 of France’s smaller cities.

With both these areas corresponding to 57% of the French population, the rural regions occupied by 43% of France’s population were still uncovered by commitments to roll out ultra-high-speed broadband infrastructure.

Connecting rural areas

To meet the need to connect premises in rural areas, it was decided that local authorities would award concession contracts under a PPP model to private concessionaires to design, build, finance and operate broadband networks.

While investments in the two more densely populated areas are expected to come to around € 6-7 billion, implementation of this technology in the rural areas, which are known as the public initiative network area, is expected to require a total of €13-14 billion of investment, around half of which will come in the form of public subsidies, including approximately €3 billion from the French state.

Projects

Among projects in rural areas, the €900 million Nord-Pas-de-Calais project was the biggest so far, aiming for a fibre-to-the-home (FTTH) network with 680,000 'homes passed', or connections to premises made. Meanwhile, the €480 million Alsace project, which also closed last year, aims for 380,000 fibre-optic connections.

Smaller deals have also been awarded for a number of France’s departments, including Vendee, Ardeche and Drome, with around 100,000-150,000 connections targeted for each.

Now the Grand Est project will be awarded by the end of this year, comprising connection of 850,000 lines. It will cover all departments of the Grand Est region in eastern France excluding the Alsace area.

The consortium of Mirova and Axione, which placed a winning bid for Nord-Pas-de-Calais, will also bid for the Grand Est project, Mirova’s investment director for infrastructure funds Steve Ledoux said. Other companies expected to bid include Orange, SFR, NGE Concessions together with Altitude Infrastructure, Covage, and possibly TDF.

FTTH networks awarded and being rolled out represent a target coverage of about 33% of the lines planned under the public initiative programme, said Ledoux. And with fifteen more regional or departmental projects, including schemes in the Gironde, Mayenne, and Charente Maritime departments, expected to be awarded by the end of the year, awarded projects will soon represent a target coverage of around 6 million lines, or around half of the lines planned for the public initiative network, he said.

Support and financing

Many of these projects have received a significant amount of public support. For example the French government provided €164 million of grants for the Alsace project. And public sector bank Caisse des Depots has taken an equity stake in many projects, providing around €15-20 million for each of the smaller projects and €100-130 million for the larger ones. “We are not part of the bidding consortia. We only invest when the chosen candidate is in exclusive negotiations with the grantor. But bidding consortia can always assume a 20-30% contribution from Caisse des Depots,” said the bank’s digital infrastructure expert Gaël Sérandour.

In terms of commercial participants, all debt and equity for projects has come from French banks, funds, and institutional investors, bringing in groups including Mirova with its partner Axione, the Marguerite Fund, NGE Concessions, Altitude Infrastructure, as well as SCOR Investment Partners, Societe Generale, Credit Agricole, Natixis and a number of local banks. Bidding groups have also included integrated telecoms operators such as Orange and SFR.

Meanwhile, although the European Investment Bank contributed Nord-Pas-de-Calais project, no commercial international lenders have been involved in these transactions to date. However, this may change, one source suggested, indicating Norddeutsche Landesbank Girozentrale from Hannover said they might be interested in lending to some of the upcoming deals. “And I heard about another one also from Germany,” the source said.

However, pricing on debt for the transactions is still high, reflecting the three- to five-year time frame required for rolling out connections and the risk associated with the speed at which ADSL customers will migrate to fibre optic networks. For the Alsace project, pricing started between 200-250bp over Euribor with step-ups to above 400bp. And for the Nord-Pas-de-Calais project, senior-debt margins started in the low-200bp over Euribor range, rising to just above 300bp over Euribor.

However, once construction is complete and a significant level of client migration has been achieved, the monopolistic nature of each network means refinancings of mini-perm facilities may produce sharp cuts to margins, especially with competition from international banks heating up.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.