Fund analysis: AMP Capital global infrastructure platform

On 12 January 2017, AMP Capital announced the final close at $2.4 billion of its global infrastructure platform, which includes the AMP Capital Global Infrastructure Fund (GIF) and the relaunched Strategic Trust of Europe (SITE).

With GIF contributing by raising $1.4 billion over a 24-month period and SITE with $1 billion of seed capital, the platform has a peculiar structure and history. It was created in 2014 by converting the then open-ended European fund, SITE, into a closed-ended vehicle and launching GIF. By doing that, AMP Capital gave investors in the platform immediate access to six assets including Thames Water, CLH, Angel Trains, Alpha Trains and Newcastle Airport.

"Clients could commit and have almost 50% of their money invested straight away. It did mean that due diligence took a lot longer than it would normally if they were investing in a blind pool because they had to investigate the seed assets, too. However, the benefits of those seed assets were appreciated by many investors who came on board," said Boe Pahari, managing partner & global head of infrastructure equity at AMP Capital.

Both vehicles are unlisted, closed-ended, 10-year equity funds with an option to extend by two years. While AMP Capital only invests through GIF, investor commitments and investments are blended across the platform.

It targets global deals in the middle market segment with deal tickets of up to $200 million and companies’ price value below $1 billion. Sectors in target include transport, energy, communication and utilities.

The manager began fundraising in late 2014 and announced a $540 million first close of the Global Infrastructure Fund in March 2015. A third close was then reached at above $1 billion in February 2016. Some investors, however, missed the final close date, "but we will find a way to engage with them in the future, either through future funds or other investment opportunities," Pahari says.

Investors and investment to date

More than 50 global institutional investors committed to the platform in total. AMP Capital said that the capital is evenly distributed across the UK, the US, Canada, Japan, Belgium, Denmark, Middle East, Ireland, Australia, Spain and Finland. The majority of the investors are pension funds and insurance companies, with some family offices from the Middle East also contributing in a smaller capacity.

The only known investor in the fund to date is private equity fund of funds manager Pantheon, which emerged as an early investor when the fund launched. The UK investor base makes up 10% of the total fund's regional breakdown and it is made up of all local government pension funds apart from one.

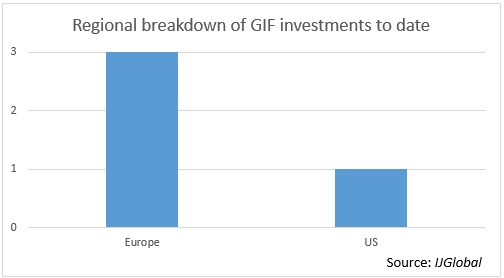

Since first close, the platform has made four investments, predominantly in Europe:

- Esvagt, an emergency rescue and response service in the European and UK offshore oil and gas and offshore wind industries.

- Adven Group Oy, a provider of sustainable energy infrastructure and services in Finland, Sweden and Estonia.

- Millennium Garages, the largest underground downtown parking system in the US.

- Axion, a leading provider of broadcasting and telecommunications infrastructure in Spain.

While three quarters of the capital deployed to date has gone into European assets, Pahari says that the US is a focus both in terms of fundraising and transactions, as the firm has a strong team in place there too.

"Other markets we like include OECD Eastern Europe, Mediterranean Europe, Brazil and OECD Mexico and Chile. Our focus now is on managing the existing assets and investing the dry powder. We would expect to make at least three more investments, with an anticipated total of 10-15 assets," Pahari says.

Investment approach and opportunities

Pahari says the global infrastructure platform has a thematic investing approach. "We look at assets beyond what people might think are infrastructure, but they still have the traditional characteristics you look for in infrastructure such as high barriers to entry, high earnings before interest, tax, depreciation and amortisation, long-term cashflows. We look at middle market transactions where we have a real opportunity to add value for investors through our deep sector and asset management experience. To win the asset is one thing, but to deliver value over a sustained period is something else," Pahari explains.

According to the manager, a good part of AMP Capital's strength resides in its global footprint and ground presence as well as its asset management capability.

"Our middle market strategy and our global network with local presence allow us to source attractive deals across different sectors and regions. We also have a very strong and experienced asset management capability which means we are able to continue to deliver value across our investments," he concludes.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.