Vietnam: last chance for coal?

The race is on to arrange financing for at least some of the 12 coal-fired power plants stuck in financing limbo in Vietnam, and many in the market fear that unless they can make progress in 2017, the projects will have to be abandoned.

In early November 2016, Vietnam dropped its plans to build nuclear power plants and at the same time said it would make up the shortfall with new coal-fired generation.

The government intends to build 31 coal-fired power plants to meet nearly half of the country’s electricity needs by 2020, according to the National Power Development Masterplan for 2011-20. Vietnam is hoping to continue to build another 21 coal-fired plants over the following decade, taking the total to 52 plants by 2030.

But despite being one of Asia’s star economic performers with a growth rate of over 6%, the government’s priority is to reign in public debt, in part by curbing investment in infrastructure. In 2015, Vietnam’s national debt burden increased to 62.2% of GDP. The World Bank is forecasting public debt will rise to 63.8% of GDP in 2016 and to 64.4% in 2017.

As a result, 40 power plants and hundreds of transmission network projects are short of funding, according to the Ministry of Industry and Transport.

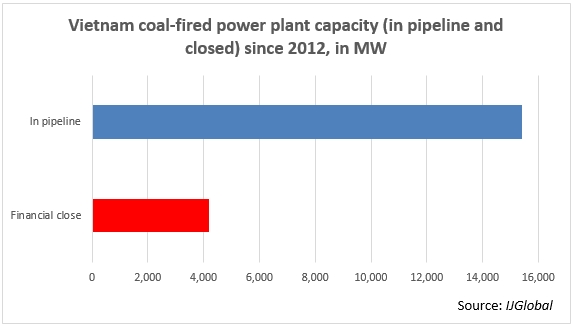

However, of the 18 large scale coal-fired power plants that have been proposed by domestic and international investors since 2012, just six state-owned companies have managed to reach financial close, according to IJGlobal data. In terms of MW, some 15,420MW of coal-fired power plants with mostly international sponsors need to arrange financing, while state sponsors reached financial close on only 4,188MW of capacity.

Hanoi’s solution is to call on foreign investors but with some onerous demands, including a refusal to guarantee more than 30% of the power purchase agreement with state utility EVN. Investors are encouraged to obtain official development assistance from their own governments as well as what the Ministry of Industry and Transport calls, according to a state media report, “overseas preferential credit.”

Those involved in some of the 12 coal-fired power plants stuck in financing limbo are now arranging the export credit themselves.

Some progress is being made. After years of limbo, the banks were mandated in January on the $2 billion 1,200MW Vung Ang 2 and the $4 billion 2,000MW Nam Dinh 1 while the $4 billion 2,000MW Vinh Tan 3 went to market to hold discussions with potential syndicate banks.

The financing on all three coal-fired power plants is expected to closely resemble the package for PetroVietnam’s $1.2 billion 1,200MW Song Hau 1 coal-fired power plant. On that deal, Korea Trade Insurance Corporation (K-Sure) and Korea Export-Import Bank (Kexim) are jointly providing financing of $987 million and a club of nine international banks will provide a further $213 million 10-year syndicated loan.

The respective export credit agencies for each project’s sponsors are expected to provide the bulk of the financing on Vung Ang 2, Nam Dinh 1 and Vinh Tan 3. Japan Bank for International Cooperation is on Mitsubishi Corporation’s Vung Ang 2, K-Sure and Kexim on Taekwang Power’s Nam Dinh 1 while Sinosure and China Development Bank will be backing Vinh Tan 3.

However, the Paris Climate accords is pushing governments to back away from coal and the window for export credit agencies may be closing.

“If these deals don’t make progress in 2017, it’s difficult to see how the export credit agencies can commit to providing significant funding after that,” a financial adviser on one of the plants that is making progress told IJGlobal.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.