Data Analysis: Growth in US social and water deals

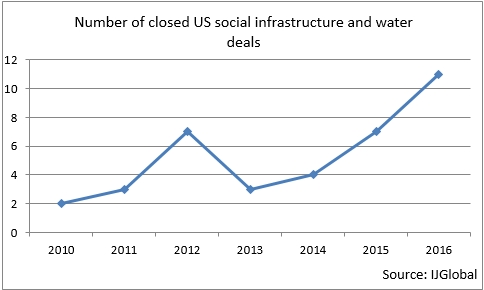

Social and water infrastructure transaction volumes have been on a gradual rise in the US between 2010 and 2016, according to IJGlobal's financial close data.

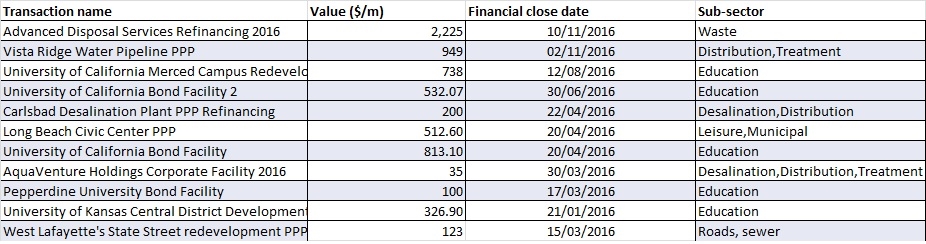

Projects with a total value of $6.5 billion reached financial close in 2016, the highest yearly total since the first social infrastructure transaction closed in the country in 2010. It was nearly double the total of 2015 when seven transactions closed with a total value of approximately $3 billion.

The first social infrastructure PPP to reach financial close in the country was the Long Beach Courthouse project in California. Since then several states, cities and municipalities have issued tenders inviting the private sector to partner with them to build their infrastructure pipeline. More states have also been passing PPP enabling legislature, with a total of 33 US states, District of Columbia, and the US territory of Puerto Rico having enacted statutes to date.

While most projects procured in the US still tend to be in the transport sector, there has been a steady growth in non-transport deals coming to market. US transportation also remains at an advantage by being backed by federal government schemes such as low interest TIFIA loans and dedicated bond programmes like private activity bonds (PABs).

That said, the deepening US private placement market and each successful financial close in the social and water infrastructure sector has boosted confidence in a wider array of investors for such assets. Three significant private placements that financed PPP projects in the US closed in 2016 including the University of California Merced project, the City of West Lafayette's $123 million State Street redevelopment PPP and the $520 million Long Beach civic center PPP.

International long-term investors such as pension funds and other institutional investors are making an entry into the US social infrastructure sector through the private placement route. The Long Beach civic centre's $239 million, 34.5-year average life term private placement bond issue was entirely covered by Allianz Global Investors (AllianzGI), marking their first social infrastructure PPP investment in the US.

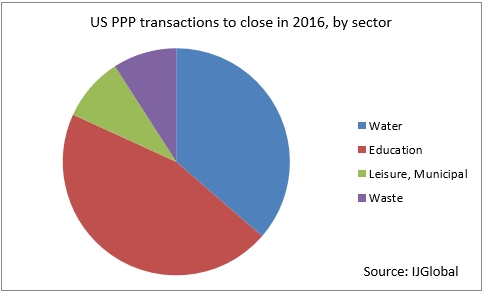

Among sub-sectors, the higher education sector remains one of the most active ones in terms of new procurement. Universities across the US are experiencing an ageing and outdated student housing stock which is in need of refurbishment. It is also a sector that investors particularly like as it is backed by a visible revenue stream. Overall the long-dated nature of social infrastructure deals and low volatile nature makes them a good fit for long-term debt, equity investors and particularly institutional investors that are gradually growing less shy of development risk.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.