The attractiveness of UK Student accommodation

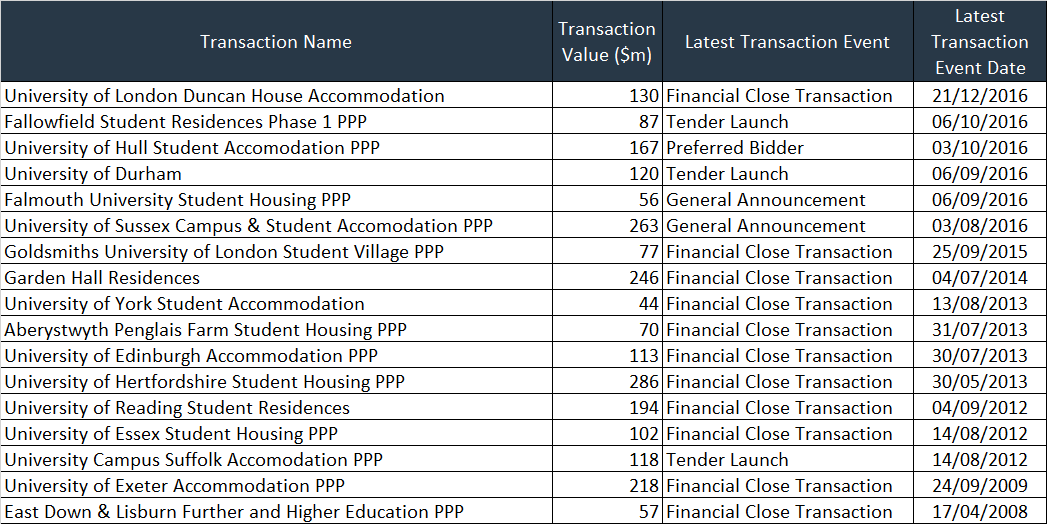

Last year, the UK university accommodation sector saw a flurry of activity. The University of London closed on the Duncan House transaction in December, while there were procurement processes announced for student accommodation at the University of Sussex and Falmouth University, the selection of a preferred bidder for a project at the University of Hull, and tenders launched at Manchester University, and Durham University. Other transactions were also completed, including Arlington Investors’ and Campus Living Villages’ bond issue for their acquisition of seven student accommodation assets spread across Birmingham, Cheltenham, Exeter and Gloucester, in addition to the development of another facility in Birmingham.

A number of factors has contributed this surge in activity, including increased demand. With three students for each bed, a ratio that is expected to remain unchanged for the next couple of years despite increasing numbers of beds, competition for bed space can be tight. Meanwhile, ever increasing property prices across much of the UK mean that many private rental properties outside the student accommodation market that were previously occupied by second or third-year students are now rented by young professionals struggling to buy property. Increasing number of international student has also boosted demand.

Portfolio acquisitions

With increasing maturity, the sector has also started to attract different types of investors. Over the last 10 years, student accommodation has been providing returns for private equity investors, and with the asset class demonstrating stability, with returns perhaps not as exciting as may have previously been experienced, institutional investors and sovereign wealth funds have also started to show interest, explained industry veteran Bob Crompton at Threesixty Developments. “Student accommodation has gone from alternative investment to mainstream,” he said.

According to information from JLL and Cushman Wakefield, transaction volumes in 2016 stood at £3.1 billion ($3.89 billion) and £5.7 billion in 2015, compared to yearly levels closer to £2 billion in 2013 and 2014.

In last year’s biggest transaction, Singapore’s sovereign wealth fund GIC teamed up with student accommodation developer GSA to acquire a £700 million 7,150-bed UK student accommodation portfolio from funds managed by US asset manager Oaktree Capital Management. The portfolio includes 3,634 operational beds across nine purpose-built student accommodation properties located in Liverpool, Bristol, London, Edinburgh, Cardiff and Southampton, as well as a pipeline of 3,516 beds in Plymouth, Portsmouth, Birmingham, Bournemouth and Cambridge.

Earlier in the year, Canadian real estate company Brookfield made its first investment in student housing when it bought private equity firm Avenue Capital’s 6,000-bed UK portfolio for approximately £420m.

And 2015 saw even more activity, with the Canada Pension Plan Investment Board’s (CPPIB) £1.1 billion acquisition of the UK student accommodation portfolio operating under the Liberty Living brand from the Brandeaux student accommodation fund. Later that year, CPPIB also acquired another UK portfolio of five student accommodation residences comprising 2,153 beds from developer Student Castle for £330 million.

Others have also made investments in the sector in recent years, including investment manager Henderson Global Investors, Insurer Aviva, private equity firm BlackRock, real estate investment manager LaSalle and investment manager M & G

Brexit

And more activity is expected, with more development and more portfolio consolidation. But the outcome of the UK’s referendum on EU membership does cast a shadow on the sector. Ultimately, if EU students find themselves paying fees as high as their non-EU counterparts—multiples higher than current levels—this may dent enthusiasm for studying in the UK. However, the 15% drop in the value of pound does counterbalance that, to some extent. And before fees actually change, the cheaper pound may even have a positive impact on UK university attractiveness for EU students.

And even after fees increase for these students, there is a strong likelihood that non-EU students will make up for the shortfall. After all, EU students account for a mere 6% of the total population, noted Paul Gorrie, analyst at Numis Securities. Meanwhile, Cushman Wakefield estimates that the non-EU student population now stands at 284,000, or nearly one in five students.

And despite the push towards tightening rules on immigration, making it harder for international students to come to the UK is unlikely to bring much benefit. After all, international education is one of the things the UK does best and brings in significant revenue. And the majority of people don’t consider international students—most of whom return to their countries of origin after completing their studies--part of the perceived immigration problem, Gorrie highlighted.

Location

So the sector is likely to remain attractive over coming years. But investors must tread carefully.

One important criterion is the location of the student accommodation, Gorrie explained. “There’s still the ability to differentiate between assets that will be strongly let versus those that will fall by the wayside,” he said pointing to Unite Students as a provider that has been particularly effective at letting its properties. James Hanmer from Savills agrees. “We tell investors to be very selective about where they buy,” he said.

And some locations may not see continued activity, as availability of student accommodation comes into line with expected demand. “We have moved from a structural undersupply to a situation where some towns and cities are in balance with a few potentially moving towards saturation,” said Hanmer.

* Data from IJGlobal, thumbnail picture provided by University Partnerships Programme

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.