European equity leads US infrastructure investment

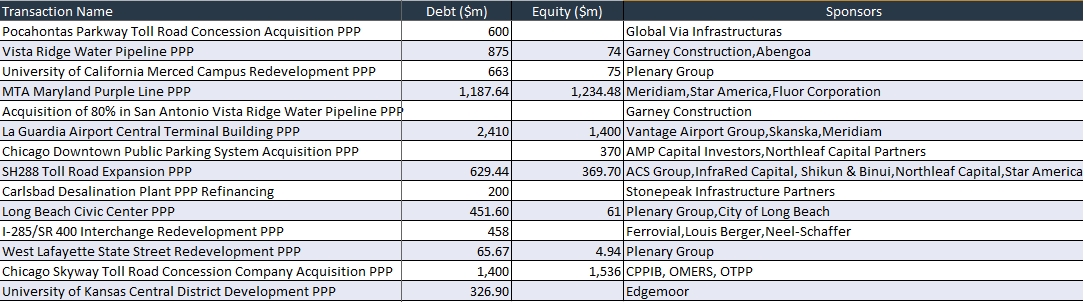

The US infrastructure market witnessed 14 financial closes, across PPPs and secondary market transactions, over the course of 2016 with a total deal value of $14.4 billion of which about $5.12 billion was equity and the remaining debt.

More notably, international investors including European, Australian and Canadian sponsors lead the equity investment in the majority of the deals that closed in 2016.

A key reason for that trend is the growing use of the PPP model in the US where the public sector shifts the risk of construction, financing, operation and maintenance of an asset to the private sector over a fixed concession period. That is a model that sponsors from the UK, Europe, Australia and Canada are all too familiar with.

The PPP model has been used widely and repeatedly in the UK, Europe, Canada and Australia and sponsors from these countries have been at the forefront of bidding for deals and winning contracts outside of their home countries, particularly in the US.

According to World Bank figures, 33 US states, District of Columbia, and the US territory of Puerto Rico have enacted statutes to date that enable the use of various PPP approaches for the development of transportation and social infrastructure projects. States are not only enabling the legislature but also putting it to use, as both PPP deal value and number of deals closed in 2016 doubled over that of the year prior in 2015.

Australian sponsor Plenary and French fund manager Meridiam reached financial close on landmark US deals in 2016 including the LaGuardia Airport terminal redevelopment PPP, the first true airport PPP in the US, and the Long Beach Civic Center and University of California's Merced Campus redevelopment in California.

But it is not just international equity investors that are making a run for US assets. Debt providers like German insurer AllianzGI have also been focusing their efforts on projects stateside, reflecting a growing appetite for long-dated US assets as the secondary market continues to heat up in the country. After making its first investment in a toll road in 2015, AllianzGI returned to invest in another toll road in 2016 -the Pocahontas Parkway Toll Road Concession. Incidentally that deal also marked the first North American investment for the Spanish developer Global Via Infrastructuras that has said that increasing US investment is part of the company's strategy going forward.

A trio of Canadian institutional investors also made their first investment as a team in a US toll road deal in 2016 with the country's three major pensions; Canada Pension Plan Investment Board, OMERS and Ontario Teachers' Pension Plan buying the Chicago Skyway toll road concession.

However does this mean that the returns from these investments are also taking a flight out of the US? A European fund manager and equity investor points out otherwise. They say that their country specific funds mostly comprise commitments from local state and city pension funds and institutional investors and therefore the returns made remain in the country. This, they say, is particularly important today in the US as political sentiment is increasingly in favour of keeping both jobs and investments within the country.

A couple of the major deals that are in procurement, and a few that are likely to reach financial close this year including Virginia's Interstate 66, Colorado's Interstate 70, the bi-national Gordie Howe International Bridge PPP, are also being led by international investors which could see this trend extend into 2017 as well.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.