Data Analysis: Chile leads LatAm infra finance in 2016

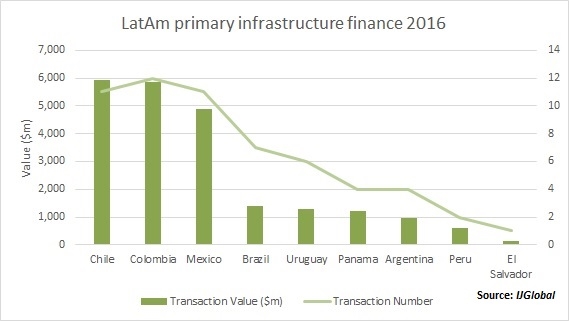

Chile was the most active infrastructure finance market in Latin America during 2016. It saw the greatest value of primary financing deals close in the region, worth more than $5.9 billion according to the IJGlobal database.

A number of major project financings closed over the year in support of some of Chile's most significant energy and infrastructure assets.

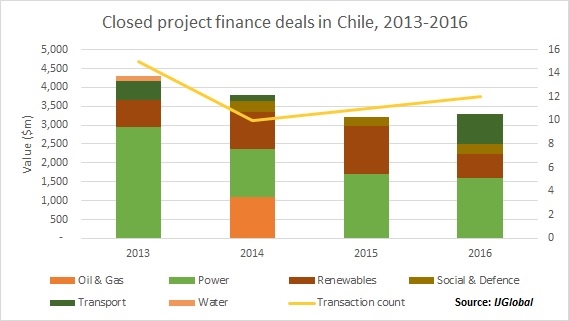

In 2016 around $1.6 billion worth of power deals closed, compared to $2.9 billion in 2013. Declining activity in this sector reflects Chile’s energy policy which has moved away from conventional baseload power in favour of renewables.

However, two landmark transmission projects reached financial close last year. They are the $750 million debt package in support of the TEN transmission line, which will connect Chile’s central (SIC) and northern electricity grids (SING), and the $850 million financing for the Interchile transmission project. Both projects will serve to reduce congestion of the national transmission system caused by a boom in renewable energy generation capacity.

There was a rise in closed transport deals in Chile during 2016, a sector which has been far less active than the energy sector in recent years. The largest of which was the $500 million equivalent dual-currency loan package backing the expansion of Santiago’s Arturo Merino Benítez airport. The deal is considered one of the most important infrastructure projects to be tendered by Chile's MOP in the last decade.

Six renewables deals closed in Chile during 2016, which is the same number as in 2015. However, the six transactions closed in 2015 raised almost double the amount of debt closed last year, as the projects were on average much smaller in terms of installed capacity (MW).

The largest two renewables deals to close in 2016 were EDF’s 115.5MW Cabo Leones I wind and 115MW Santiago Solar PV projects. The French developer was also the most active sponsor by this measure in Chile in 2016. While in 2015, the largest projects to close in Chile were LAP’s 185MW San Juan wind and SunEdison’s 146MW Laberinto merchant solar projects.

Mainstream was expected to achieve financial close on the Aela wind portfolio – which comprises the Aurora, Sarco and Cuel projects – by year-end, but the deal is now due to close in 2017. Six mandated lenders are expected to provide the credit facility.

Another major transaction in the market is Octopus LNG, which signed an $850 million term financing in December 2016 backing the development of a 600MW gas-fired power plant and the offshore Penco Lirquén LNG regasification terminal to be located in Chile's Bio Bio region. The deal is expected to meet conditions precedent for financial close in 2017.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.