Can MENA solar prices continue downward momentum?

Solar development is continuing apace in the Middle East and North Africa (MENA) with Saudi Arabia announcing plans for up to $50 billion of renewables projects by 2030. With bid pricing per kWh dropping substantially in recent years, can price reductions continue at this speed?

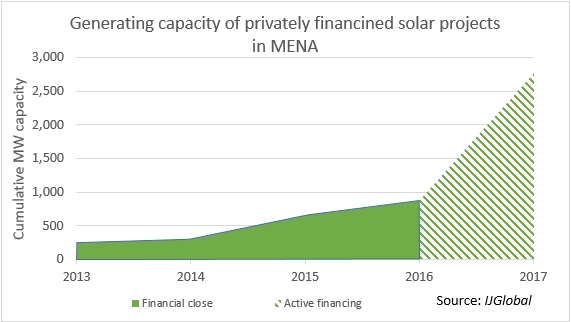

The cumulative amount of privately financed MW of solar capacity in the MENA region hit 875MW in 2016, according to IJGlobal data. If the 800MW Rashid al Maktoum III project in Dubai and over 1,000MW Sweihan project in Abu Dhabi reach financial close this year, it could be the most successful on record for adding capacity.

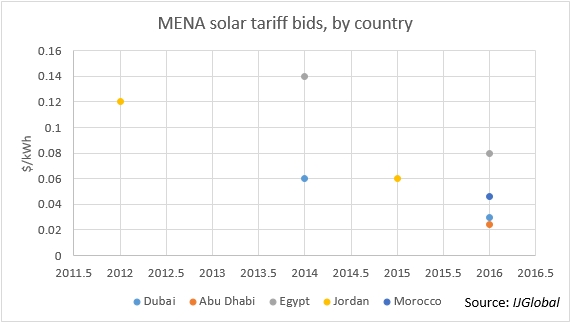

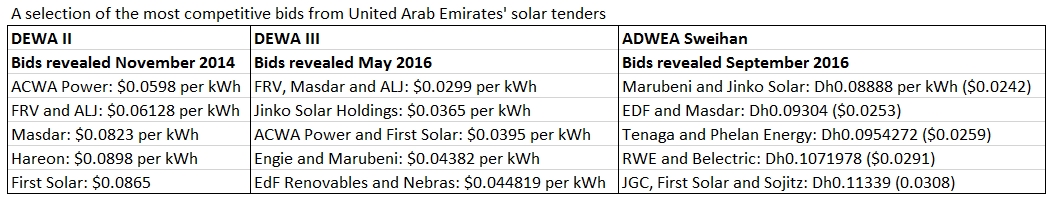

This desire for more clean energy generation has seen increasingly competitive bidding in the region’s solar tenders with both Abu Dhabi and Dubai seeing new world-record low prices in recent years.

The trend of ever-lower prices of solar electricity looks set to continue with a number of new projects in the pipeline and high levels of competition.

Saudi Arabia received over 200 expressions of interest for its own solar tender in 2016. Bids for its Al-Jouf and Rafha solar projects are due in on 28 February 2017.

Some bidders have questioned if such low tariffs can be maintained.

“The tariff is significantly lower than us,” one commented. “I’m not sure this is sustainable, it’s too cheap”, one said.

And financiers have also pointed out that capital expenditure is low in part due to excess solar modules from bankruptcies in the manufacturing and developer segments.

“Capital expenditure has become ridiculously low and is driving lower tariff prices because of a glut of solar modules in the market,” one banker commented. “This isn’t helped by SunEdison’s bankruptcy. Suppliers are stocking up on modules because they’re lying idle in factories and there’s an overcapacity in the supply market.”

Solar prices depend on the cost of construction and operation, the cost of debt, and sponsors’ expected internal rate of return. With debt prices edging up over time as the low-oil price environment bites into regional government budgets and supply of excess solar modules unlikely to be permanent, it seems unlikely prices can continue to drop at such a sharp rate.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.