Data Analysis: North American PE in Latin America

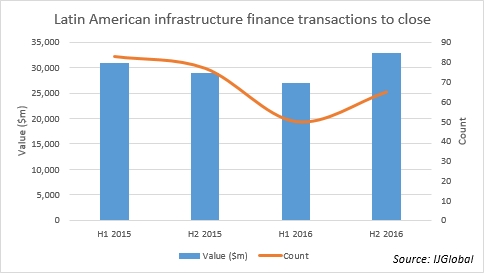

North American private equity firms made their mark on Latin America last year taking advantage of energy reform in Mexico and the financial crisis faced by Brazilian sponsors.

A number of US and Canadian PE firms made it into the top 20 of IJGlobal’s infrastructure finance sponsors’ league table for Latin America in 2016.

Brookfield Asset Management was the highest ranking, closing three deals in the region in 2016, with a total value of $2.3 billion.

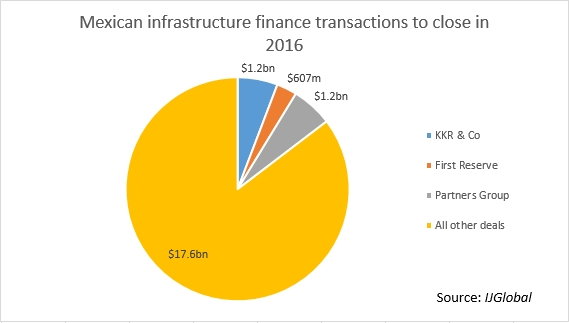

Brookfield led the way with its acquisition of a majority stake in Colombia’s Isagen at the beginning of the year. It also acquired Enel Group’s Chilean transmission lines later in the year. Brookfield was joined by KKR and First Reserve in the top 20, which closed sizeable sale and lease back deals with Mexico’s Pemex.

The Mexican energy reform, which was passed into law in 2014, dismantled Pemex’s decades-long monopoly of the Mexican oil and gas sector and opened it up to private sector investment. The deals with KKR and First Reserve serve as a means for Pemex to monetise its assets for future E&P investment. Both firms saw reform in Mexico as a foot in the door to the Mexican market and the region and will certainly be looking for further opportunities to invest in 2017.

Partners Group, through its subsidiary Fermaca, has also been incredibly active in the Mexican midstream market, bidding and winning mandates on a number of projects. Fermaca closed two pipeline deals in November 2016.

US-based infrastructure fund I Squared Capital also made a major investment in the region last year with its $1.2 billion acquisition of Duke Energy’s Latin America portfolio (minus its Brazilian assets).

Brazil’s recession and resulting political crisis has seen the federal government begin a swathe of privatisations, which will likely welcome more interest from private equity firms.

To read IJGlobal’s Regions Infrastructure Finance League Table Report click here.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.