Data Analysis: India solar powers up

India's strong economic growth has created increased electricity demand, which the government is meeting, at least in part, through a surge of new solar power plants. In 2016 the total installed solar generating capacity in India nearly doubled and in 2017 capacity is set to double up again.

The state of Tamil Nadu has in the last week launched a 500MW solar tender, while Solar Energy Corporation of India is expected over the coming weeks to open the tender for 2-3GW of solar capacity across the country.

India's economy is humming along too. Although economic growth forecasts were trimmed following the recent demonitisation of high value currency notes, the Asian Development Bank still expects India’s economy to grow by 7% in 2017 and by 7.8% in 2018.

The country also has one of the fastest-growing electricity sectors in the world, according to the US Energy Information Administration. Net electricity generation is expected to expand by an average 3.5% a year between 2012 and 2040.

Turbo charging forward

In June 2015, Prime Minister Narendra Modi officially raised the target to install new solar capacity from the previous 20GW to 100GW by 2022.

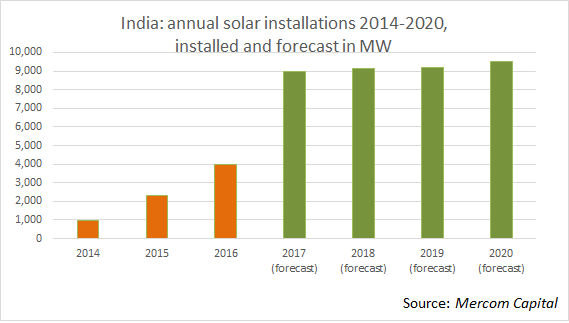

Annual installations, both of rooftop and utility-scale solar, more than doubled year-on-year in 2015 to 2.3GW and is forecast to have nearly doubled again to 4GW in 2016, according to Mercom Capital data.

As of December 2016, India had 9GW of utility-scale solar power in operation, 14GW in development and another 6,308MW that has been tendered out.

New solar capacity installations are projected to surge to just over 9GW in 2017 and continue to expand at that pace through to 2020.

Homegrown business

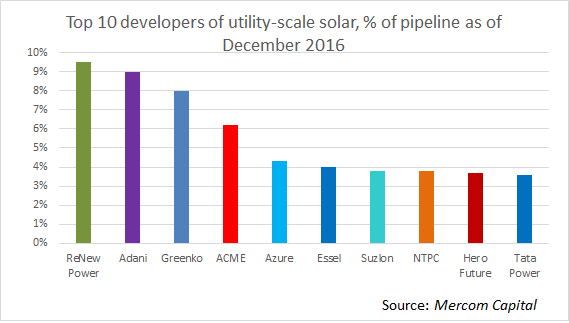

Local conglomerates such as Tata Power and Adani together own just under 20% of the utility scale solar power plants in operation in India, while US-based First Solar scrapes into the list of top 10 solar developers at eighth place with a market share slightly over 2%, according to Mercom Capital data.

Indian companies also dominate the league table for the 20GW of projects in the pipeline, with ReNew Power, Adani and Greenko leading the pack. The only internationals, Solar Direct and EDF, squeak in at the bottom of the top 20 developers in terms of pipeline.

One challenge for foreign developers is arranging financing. So far, most utility scale solar power plants in the country have been financed by Indian banks. Despite solar tariffs falling to successive historic lows in recent years to hit Rs4 ($0.07) per kWh by December 2016, an even steeper fall off in module prices have made banks more comfortable providing project financing for solar developments.

As a result, average interest rates on solar project financing has been trending down over the past year, from an average 11.50% in the fourth quarter of 2015 to just under 11% by the last quarter of 2016, according to Mercom Capital data.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.