Data Analysis: Power deals spike amid MENA market decline

While 2016 saw a resurgence in the total value of power and water deals closed in the Middle East and North Africa (MENA) region, the wider infrastructure market endured a steep decline in primary financing activity during the year.

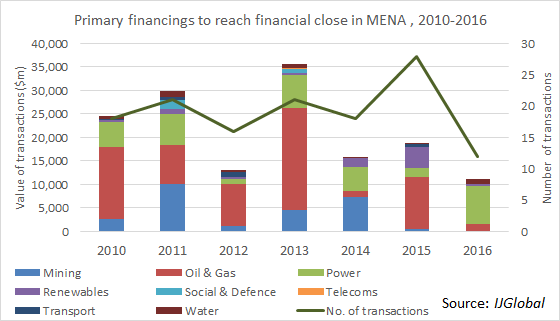

The total value of greenfield transactions to close across the MENA region in 2016 was just over $11 billion in 2016 (as of 15 December 2016) – down substantially from roughly $18.8 billion in 2015, according to IJGlobal data.

Though some additional deals may yet close this year, due to the seasonal rush to complete before 31 December, it is looking to be one of the worst years in a decade in terms of the total value of transactions completed.

And deal volume hasn’t fared much better, dropping from 28 in 2015 to just 12 deal closes across the region in 2016 so far. Most of the drop is attributable to fewer greenfield oil and gas deals, with $1.6 billion closing in 2016 against $11 billion in 2015.

The total value of successfully closed greenfield power and water deals have bucked the wider trend, however, increasing four- and five-fold, respectively. A total $8 billion of power projects closed through to 12 December 2016, and $1 billion of water deals closed.

In the power sector, the United Arab Emirates, Qatar and Oman stood out for having buoyed the figure for deal closes with $3.15 billion, $3 billion, and $1.7 billion of deals closed in each, respectively. Their combined total of $7.85 billion makes up the vast majority of greenfield power transactions to close.

The largest deals in those countries included the Hassyan coal-fired project in Dubai, the gas-fired Ibri and Sohar 3 projects in Oman, and the Facility D independent water and power producer in Qatar.

Although comparatively smaller than the power sector in terms of total deal value, the water sector also saw a number of significant deal closes for 2016 – particularly for Oman. The Barka and Sohar pair of desalination projects reached financial close in Oman after garnering project financings of $308 million and $223 million in July, respectively, following Hyflux’s financial close on the $250 million Qurayyat independent water producer earlier in the year.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.