Renzi, bailouts and Italian infrastructure

In seven days the Italian public has rejected a referendum for constitutional reform, its youngest prime minster has resigned and two of its largest banks are frantically restructuring to stay afloat.

Italy’s largest bank UniCredit has outlined a €12.2 billion restructuring plan, and the country’s third largest bank Monte dei Paschi is trying to avoid a government bailout with a €5 billion rescue plan.

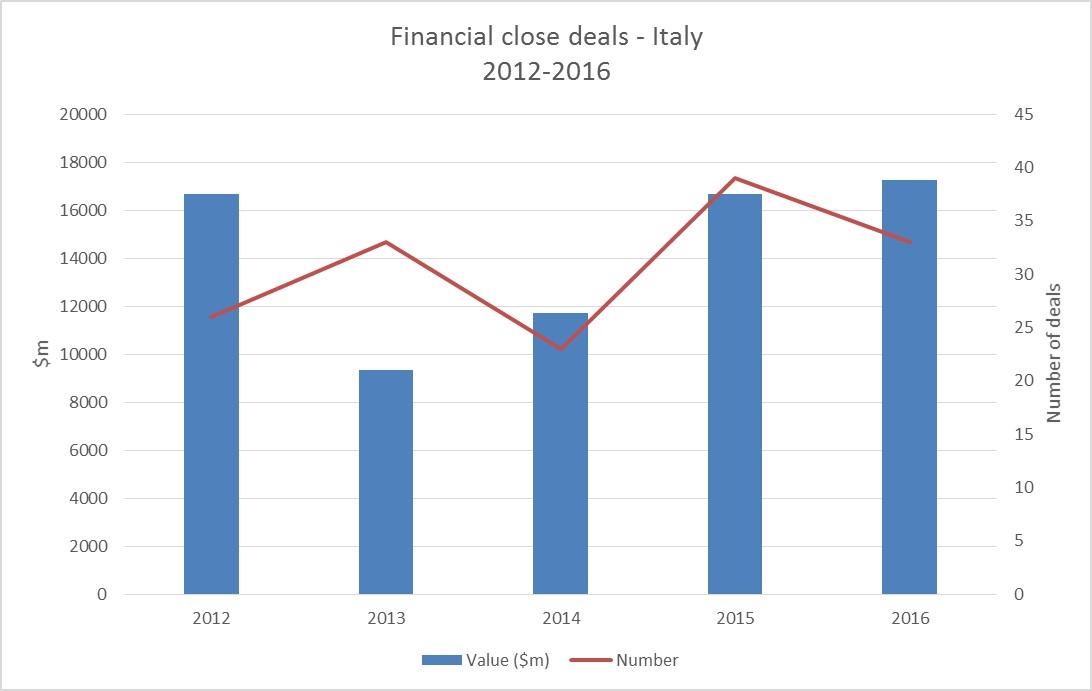

The outcome of each will certainly have ramifications for Italy economically and politically. But what does this mean for infrastructure lending?

Following the financial crisis a number of European banks were bailed out by their respective governments. Allied Irish, the UK’s RBS and Lloyds, and Germany’s Bayern LB to name but a few sold down much of their project finance portfolios and scaled back on their future lending.

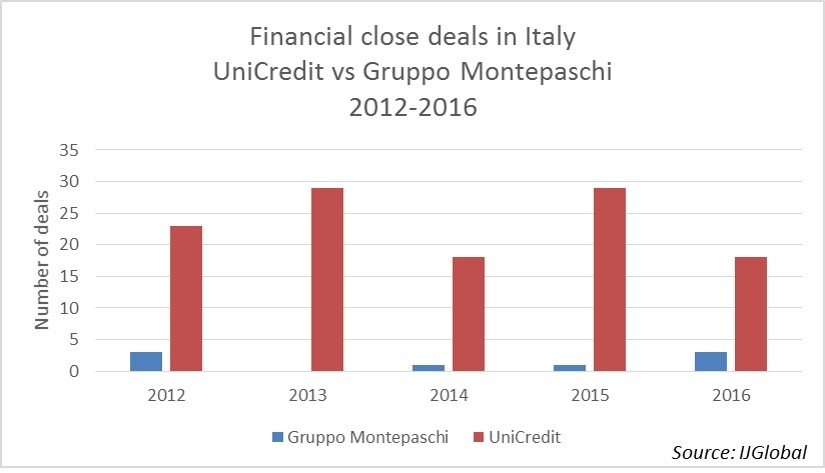

In Italy UniCredit is the more active of the two in infrastructure lending, mandated on over 50% of the deals closed in Italy this year. Monte dei Paschi in comparison lent to less than 10% of Italian infrastructure deals.

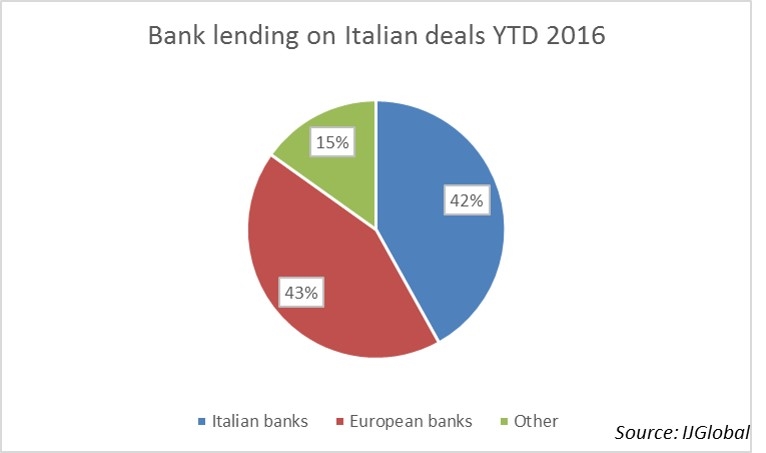

While Italian banks appear on many of the deals closed in Italy the Italian infrastructure market is not reliant on the lending power of its domestic banks. Much of the market was dominated by European and Japanese lenders in 2016.

UniCredit overall has scaled back its infrastructure activity in 2016, lending across fewer deals in the year. Any further retreat by the bank would likely be mopped up by other lenders. And with the demand for deals far outstripping the supply there will be plenty waiting in the wings.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.