Wind deals in Australia see major rebound

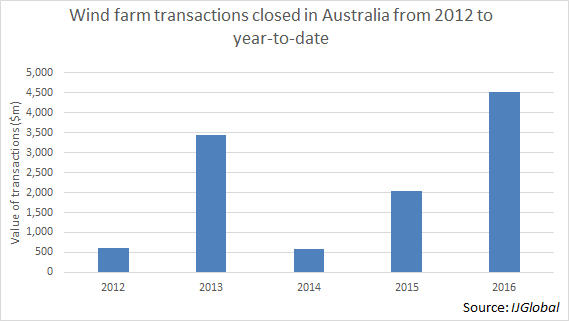

Australia saw a higher volume of wind farm transactions reach financial close in 2016 than in the previous two years, spurred in part by a major refinancing of Canunda Wind Farm.

The new debt package for Canunda includes a A$25.47 million ($18.7 million) term loan provided by ANZ Bank and Commonwealth Bank of Australia. The Canunda Wind Farm is located at Lake Bonney, near Millicent in South Australia's south-east. This year also saw the financial close of the Kiata Wind Farm (30MW) for $50 million, the Woolnorth Wind Farm for $98.5 million and the White Rock Wind Farm Stage 1 (175MW) for $219.4 million, according to IJGlobal’s data.

2015, in which 13 wind deals reached close (including refinancing projects) with a transaction deal value of $4.29 billion, also saw major growth compared to 2014. Five wind farms became operational in 2015, adding 196 turbines and 380MW of generating capacity. These additional projects took the Australian wind industry to a total of 76 wind farms with a combined capacity of 41.8GW, made up of 2,062 turbines.

Why the rebound since 2014?

The raise of deals and transactional volume in Australia’s wind power industry is partly due to the ACT Government’s reverse auction scheme, which has attracted a lot of interest. ACT-supported wind farms will deliver about 50% of the territory’s electricity supply from renewable energy sources in 2020. And in 2016, the ACT Government is running the next generation renewables auction that will drive further investment in up to 200MW of new wind or solar generating capacity.

Paul Newman, utilities partner at law firm Ashurst, who is based in Australia, told IJGlobal, that a key driver for investment in large-scale renewable energy in Australia has been the Australian Government's Renewable Energy Target (RET) scheme. The RET commenced in 2001 and in 2007 was reset to progressively increase to 41,000GWh of annual renewable energy production by 2020 for large scale generation, with the target ramping up to meet that quantity in preceding years (in 2007 this was touted as the 20% renewable target). This target will then apply through to 2030.

Newman said, “Following an election in September 2013, the new Australian government sought to significantly lower the RET, a move that initially opposed by the opposition and resulted in a high level of uncertainty in the renewables market, and a resulting decrease in investment (to almost zero), while the political discussions were ongoing.”

The decline of the levelised cost of electricity (LCOE) is also helping to make wind a cheaper source of power in Australia. Kate Papailiou, a finance and projects partner for DLA Piper, who is based in Australia, told IJGlobal: “The declining LCOE for wind power, making it a commercially viable source of generation without the need for any additional subsidy or support beyond payment for the generation and LGCs.” She also added that a viable PPA market re-emerging has given greater certainty of offtake.

2017: A good year for wind

With strong government support, 2017 should be another year of growth for Australia’s wind farm industry, continuing to push the country as a leader in wind power in Asia, and the world. The state of South Australia is a leader in the implementation of wind power in Australia, which now supplies around 40% of all power in that state.

Newman said that he expects that banks will continue to see a strong lending market to wind farm developments in 2017, but also to the renewables sector more broadly. In particular, a very active lending market to solar farm projects as the first wave of large-scale solar projects are developed in 2017 and banks become more familiar with the risks involved.

Paul Curnow, Asia Pacific head of Baker & McKenzie’s renewable energy and clean technology practice, told IJGLobal that he is optimistic about the future of wind power in Australia, but there are challenges.

“There is no doubt in my mind that planning and environmental approvals, as well as community engagement, will continue to be a challenge for new wind farms,” Curnow said. He added: “However with an increasingly liquid debt market – particularly with a number of foreign banks lending on wind projects in Australia – as well as the likes of the Australian Government’s the Clean Energy Finance Corporation - I am very confident these challenges will be met with success.”

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.