What’s in store for UK offshore wind?

The UK government set up a for-sale sign outside the Green Investment Bank earlier this year and the sale is now at an advanced stage. IJGlobal revealed last week that the government is expected to sign an initial agreement with a buyer in early 2017, ahead of an announced planned close in March.

But on 2 December 2016 it emerged that in the midst of the sale process, two of its most senior offshore wind staffers are leaving the bank. What do these latest developments mean for the future of offshore wind financings in the UK?

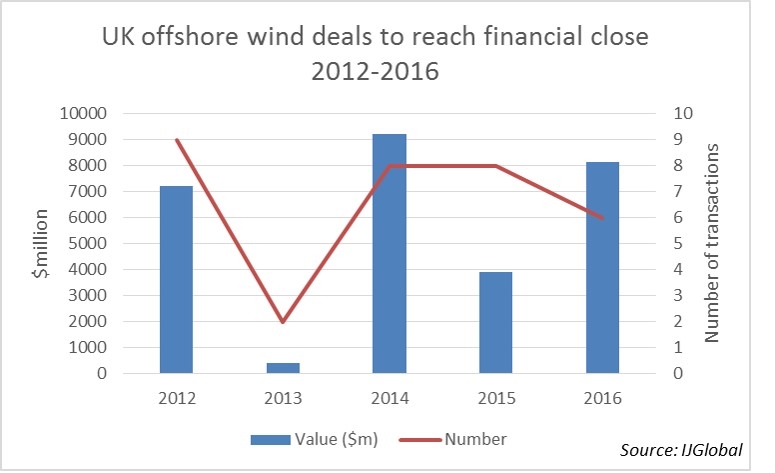

The GIB has risen in less than five years from a first-of-a-kind government pilot scheme, to a profitable bank. It has invested more than £2.7 billion to clean energy projects and mobilised £10.6 billion in private capital. The lion’s share of that capital has gone to the burgeoning offshore wind sector. According to data from IJGlobal, the number of offshore wind deals that have reached financial close in the UK since the bank was created in 2012 has been relatively consistent.

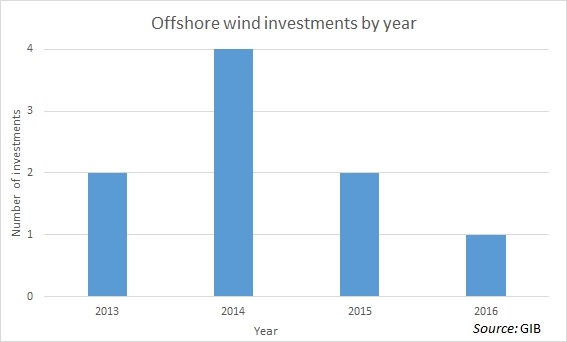

The GIB is now the biggest debt provider to the UK offshore wind sector. However its commitment to the sector has slowed, and in 2016 it made only one investment, when it acquired the GLID wind farms, in conjunction with BlackRock from Centrica and EIG. The investment was the first to be made out of its £1 billion offshore wind fund.

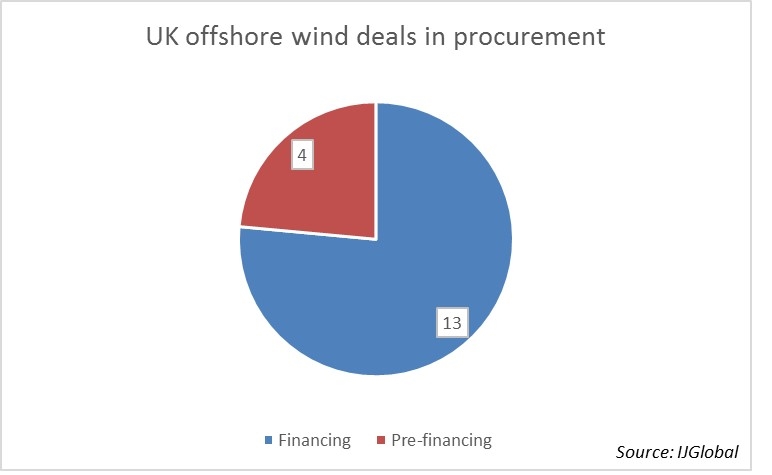

Any buyer of the bank will have a portfolio of some of the world's largest offshore wind farms to manage. But what is in the pipeline for future investments for the bank? According to data from IJGlobal there are currently 17 offshore wind projects in procurement in the UK.

Whether the GIB will continue to focus on offshore wind post-privatisation is unknown. Project sponsors are dependent upon the outcomes of the UK’s next Contracts for Difference subsidy auction, and there are other technologies and prospects vying for the bank’s capital, such as energy efficiency schemes and waste-to-energy projects.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.