Vietnam: not turning the lights on

The Vietnamese government last week cancelled plans to build 16,000MW of nuclear power capacity and state electricity utility EVN is calling for foreign investment to plug its electricity deficit. But foreign investors face a big challenge: the Ministry of Finance will only guarantee 30% of a US dollar-dominated power purchase agreement.

The government gave several reasons, aside from cost, for the decision to abandon plans to build four nuclear power plants, including safety and national security concerns.

But one of the major considerations was cost. Projections for building the plants had more than doubled to $18 billion since 2009 and 2011, when the original agreements with Russia and Japan, respectively, were signed.

Facing a rising debt burden, Vietnam’s Ministry of Finance has decided to reign in borrowings. Vietnam’s national debt burden rose to 62.2% of GDP in 2015 and the World Bank is forecasting public debt will rise to 63.8% of GDP in 2016 and to 64.4% in 2017.

One casualty of that decision has been infrastructure, including power even though Vietnam’s electricity demand is forecast to rise by over 10% year-on-year, according to EVN, out pacing the country’s expected GDP growth rate of around 7%.

In early September, EVN called on foreign investors to help fund $40 billion worth of power projects over the next four years. The state utility sees investment needs continuing to grow beyond that, to $108 billion between 2021 and 2030.

According to Vietnam's Ministry of Industry and Transport, 40 power plants and hundreds of transmission network projects are short of funding.

Insurmountable hurdle

However, the Ministry of Finance last year set a 30% cap on the guarantee it will offer on US dollar-denominated power purchase agreements.

The decision has all but ground to a halt many power sector foreign investments while investors and their bankers try to figure out what to do, a project finance banker told IJGlobal.

While the central bank, the State Bank of Vietnam, maintains the currency within a fixed band, it depreciated the dong some three times in 2015 alone – a potential headache for any banker trying to structure a currency hedge.

“We looked at it from all sorts of different angles, but there is no way to hedge against the kind of long-term currency exposure associated with an investment in a power plant,” the banker said.

Some in the infrastructure market believe Vietnam’s single party Communist government does not have the incentive to build new power plants.

“There is no democracy and the government is not under direct pressure from the public to build power plants. It can let the power shortage problem fester for a while,” one regional managing director at a technical advisory firm told IJGlobal.

Get your own help

Vietnam’s Communist government, for its part, has suggested a solution: investors are encouraged to obtain official development assistance from their own governments as well as what the Ministry of Industry and Transport calls, according to a recent state media report, “overseas preferential credit.”

That indeed may be the only solution out of the gridlock. IJGlobal understands that Japan Bank for International Cooperation, for example, is looking at ways to shoulder the currency risk for Japanese investors.

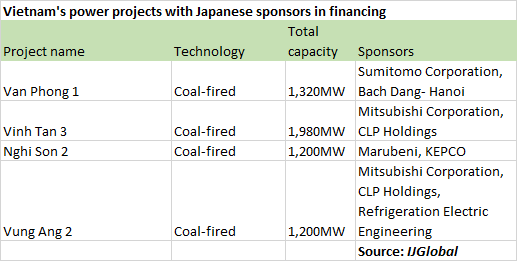

As of mid-November, IJGlobal data shows Japanese sponsors are equity investors in four power plants worth a combined $8 billion that are in the process of arranging financing:

Still, the hurdle is not high enough to put off investors entirely.

Most recently, Ireland-based Mainstream Renewable Power signed earlier this month a $2.2 billion cooperation agreement to develop 940MW of wind power in Vietnam.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.