Trump and the plummeting Peso

As we come to terms with the election of Donald Trump as the 45th president of the United States the ramifications of his presidency are already being felt by one of the country’s closest neighbours; Mexico.

The Mexican peso yesterday suffered its biggest drop since the 1994-95 Tequila Crisis, in which the country almost declared itself bankrupt. The peso fell by almost 13% to Ps20.7 against the dollar as the Mexican stock market closed on Wednesday night.

It is likely that Mexican authorities will have to intervene. The question is what impact will this have on the country’s energy and infrastructure projects.

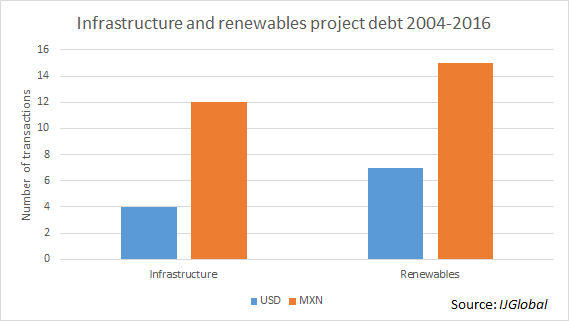

The majority of Mexico’s infrastructure projects have revenue streams paid in Mexican pesos. This is not a major issue as project debt is also primarily Peso denominated and provided by Mexican banks. The drop in the peso has little material impact on sponsors’ ability to service their debt.

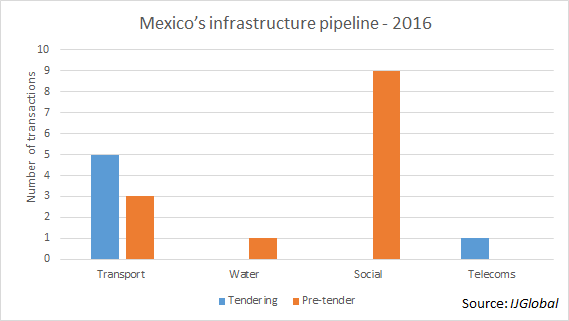

What impact the devaluation of the currency will have on the highly liquid local bank market remains to be seen. Mexico has a significant pipeline of new infrastructure projects due to be tendered next year. According to IJGlobal data this list includes nine hospital projects and a further three transport projects, to add to the five already launched. The expectation is that these projects would be financed in Pesos.

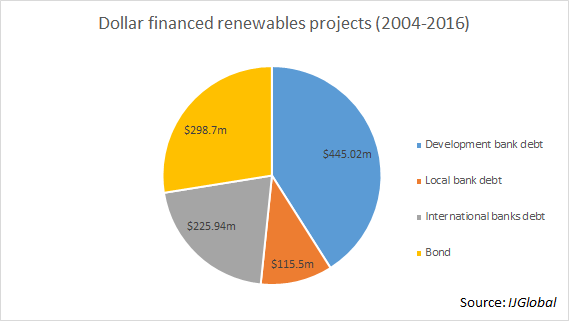

The impact on existing energy projects could be different. Most large scale oil and gas and power projects are financed in US dollars and have US dollar revenue streams. However in the renewables sector most existing PPA revenues are in pesos. Akin to the infrastructure sector the majority of projects have to date been financed with peso debt. According to IJGlobal data of the 22 renewables projects closed in Mexico seven renewables have dollar denominated lending. Much of that lending comes from development banks and at least two wind farms have been financed in the US capital markets.

What impact the devaluation of the currency has on the future of energy and infrastructure development is open for debate but as for existing projects it’s clear the infrastructure finance market has already planned for such risks.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.