Europe’s intermittent energy policy

This week world leaders gathered in Morocco for the second week of the COP22 meeting. As they determine how they will put last year’s Paris agreement into action it has not gone unnoticed that just across the Mediterranean, in Europe, there appears to be little clarity on near-term energy policy.

France has asserted itself with a series of announcements to increase its renewables capacity by 2023, while the UK government last week said there will be a second CfD auction next year for plants set to be delivered in 2021/22. Both are at least trying to set out some concrete energy policy, albeit for the long term.

There is a general consensus that Europe must increase its share of renewables capacity. The EU 2030 Framework for climate and energy has set targets for a 40% reduction in greenhouse gas emissions compared to 1990, and at least 27% of energy consumption to come from renewable energy.

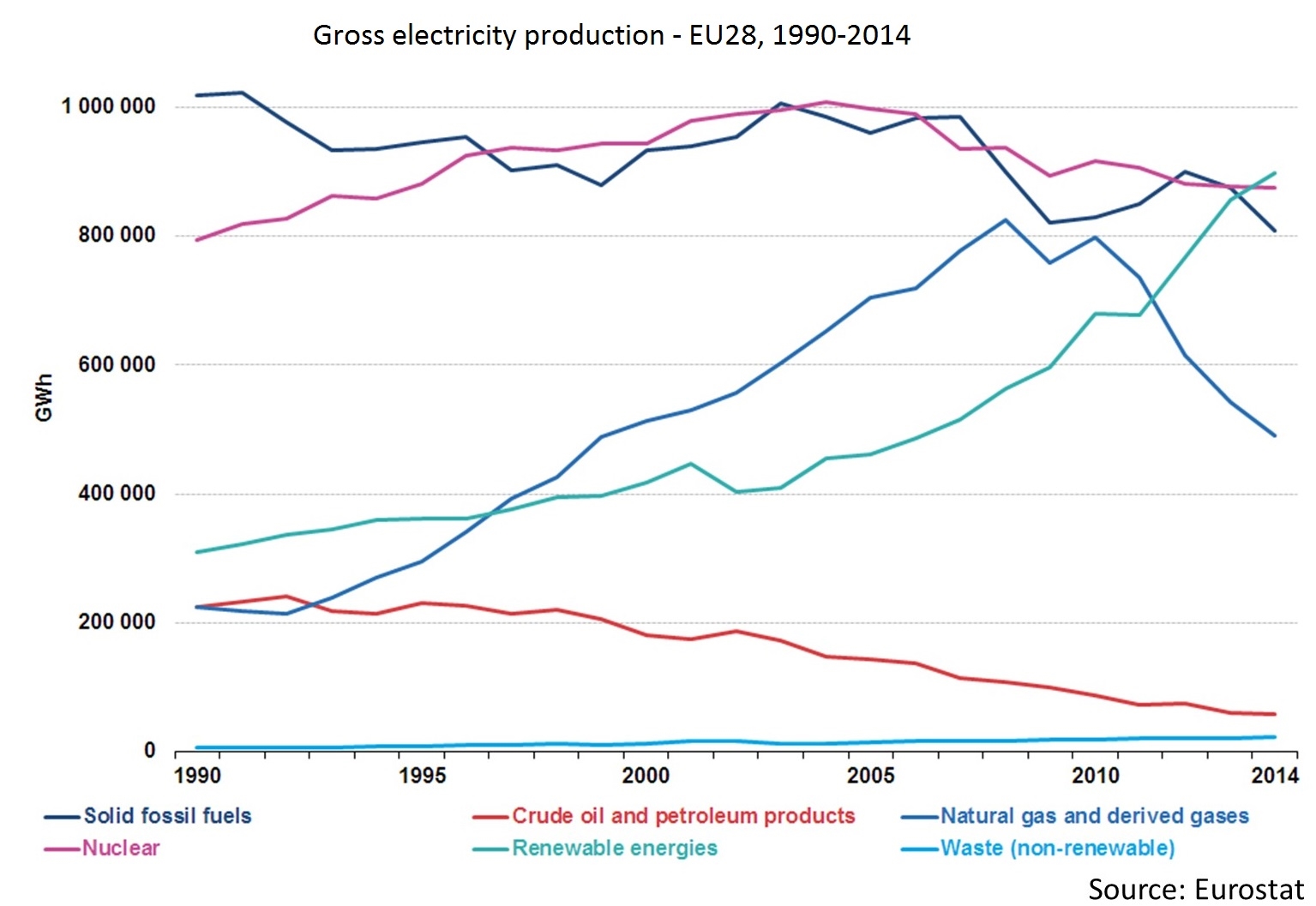

As the reduction of carbon emissions becomes a global political priority, renewables development has risen, especially wind and solar. According to data from Eurostat, since 1990 electricity generation from renewable energy sources has nearly tripled.

However the intermittency of renewable energy means that renewables is unlikely in the near term to be able to completely replace conventional baseload power. The advancement of battery storage projects is likely to change this, but until that time there remains a need for conventional power.

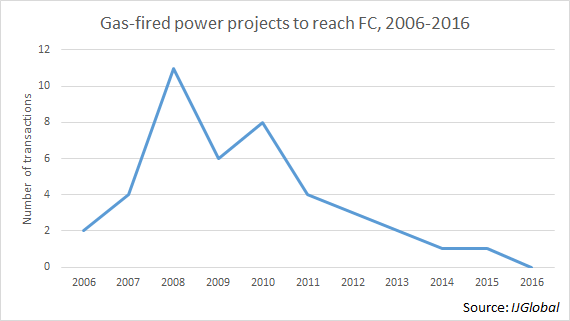

Where will that baseload come from? EU targets are firmly set to reduce coal-fired power, and post-Fukushima, a number of EU countries have decided to phase out nuclear. Gas-fired power is one baseload solution as a bridge to renewables baseload. It wouldn’t be remiss to expect then that there would be a substantial pipeline for gas-fired power in Europe. According to IJGlobal there is just one gas fired power plant in procurement in Europe at the moment; the Trafford CCGT project in The UK. And since the beginning of 2015 only one gas fired power project reached financial close, whilst a further two were cancelled.

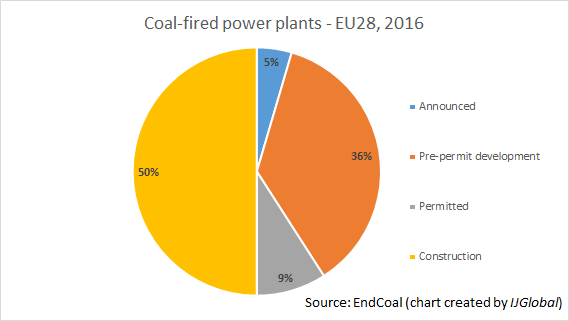

Meanwhile according to data from EndCoal there are eight coal-fired power plants in construction in the EU, and a further two have been permitted.

Without any clear policy from European governments, and with no visible pipeline for gas-fired power it’s difficult to see how Europe will meet its targets for 2030.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.