The future of CCS in Europe

In the first week of November 2016 a group of 10 global oil and gas companies said they will commit $1 billion to help roll out commercial-scale low emissions technologies, of which its initial focus is carbon capture and storage.

The oil and gas firms providing the funding are BP, CNPC, Eni, Pemex, Reliance Industries, Repsol, Royal Dutch Shell, Saudi Aramco, Statoil and Total: the 10 combined represent one fifth of the world’s oil and gas production.

Carbon capture and storage traps carbon emissions from fossil-fuel burning plants and stores it underground. The technology as a solution for reducing carbon emissions has been touted for decades, but it was only over the past 10 years or so that it began to be seriously talked about by governments. Canada launched the world’s first CCS plant, the $1.3 billion Boundary Dam project, in October 2014.

Dearth of greenfield projects

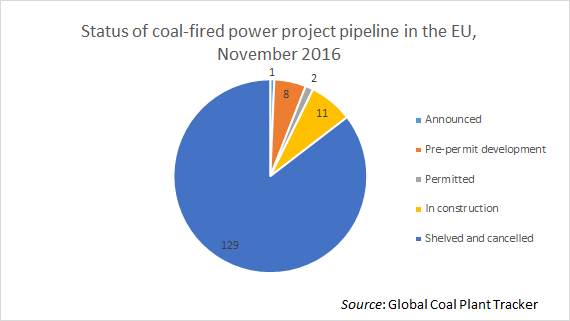

Despite this renewed interest in CCS, the number of conventional power projects being procured globally has significantly reduced in recent years. This trend is particularly pronounced in Europe. Data from Global Coal Plant Tracker shows that there are just two permitted conventional power developments in the pipeline in EU countries: one in the UK and one in Greece. In comparison, there are 129 cancelled developments.

There may be some opportunity to retrofit existing projects however. There are an estimated 708 operational coal-fired plants in the EU, but these are reducing each year in line with EU carbon reduction demands. Europe, and more specifically the UK, is a likely focus for CCS development as, besides Canada, it has done the most to accelerate the technology.

However, the oil companies will have to work hard to convince existing asset owners they are serious about their plans. CCS has had a chequered history of support being offered and then taken away.

Support scrapped

It had seemed like the UK would follow Canada as the next country to develop a CCS project. A £1 billion CCS commercialisation competition was launched in the UK in 2014, and two projects subsequently emerged.

One was the retrofitting of the 2.1GW Peterhead power plant in Scotland and the other the 426MW, £2 billion ($3.3 billion) White Rose project in Yorkshire, England. Alstom, BOC and Drax Power headed up White Rose, while SSE and Shell developed the Peterhead project.

Around £100 million of funding was invested by the state in the planning and engineering of the projects, and the sponsors began hunting for financing. The White Rose project was awarded a €300 million grant from the European Commission in July 2014. The UK also agreed to co-develop the technology with Canada.

Then in November 2015, the UK government performed a volte-face: it dropped the £1 billion backing for the two projects and cancelled its CCS scheme, citing Treasury budget concerns. The surprise decision drew widespread criticism, as the government had already said it would support the two projects under the scheme.

In the wake of the UK government's cancellation of its scheme, both projects have since been abandoned.

Green shoots

There are green shoots of growth for the fledgling industry, though; in early October the UK’s Energy Technologies Institute hired French engineering and construction group SNC-Lavalin to co-develop a proposal for a gas-fired power plant fitted with CCS.

They will work with Aecom and the University of Sheffield on the nine-month project, which could herald an evolution for CCS into a technology primarily for gas-fired plants, rather than coal. The cost of this one proposal alone, however, is £650,000. While the $1 billion figure from the 10 oil companies sounds promising, as demonstrated by the price tags of the cancelled projects, this amount would fail to meet the capex of a single proposed power plant to date.

At a time of scant greenfield conventional power projects in developed countries, further research and focus on CCS, both for exisiting and new plants, may well provide a solution for providing low-carbon baseload energy capacity. Much more than $1 billion dollars will be needed to achieve this, however.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.