A decline in Asean renewables

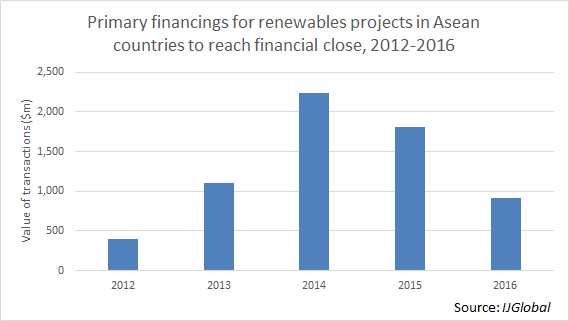

Financing volumes for greenfield renewables in the Asean (Association of South East Asian Nations) region have dropped off significantly since 2014, mainly due to low input costs for conventional power plants.

IJGlobal’s data shows that primary financing volumes for renewables in Asean reached a high in 2014, reaching around $2.25 billion, but then declined to roughly $1.8 billion in 2015.

2016 is shaping up to be an ever slower year for renewable energy investments in the region. There have only been 13 renewable energy deals in Asean in the year-to-date, the largest of which was the $850 million, 240MW Sorik Marapi Geothermal project in Indonesia. This is the largest renewables transaction in the region, in terms of investment size, for two years, but alone is not enough not prevent a year-on-year decline.

In 2015, the largest transaction was $594 million, 120MW TuasOne waste-to-energy PPP in Singapore, followed by the $283 million, 126MW Hadkanghan wind farm in the southern region of Thailand.

Cheap coal

A key factor that has slowed down the investment in renewables in Asean is low coal prices. The share of coal-fired power generation in the region will continue to rise over the next few years, according to the International Energy Agency’s Southeast Asia Energy Outlook 2015.

The report states that, “The rise in coal use is underpinned by economic factors, abundant supplies and the need for rapid electrification, but also highlights the need to accelerate the deployment of more efficient technologies to address the rise in local pollution and CO2 emissions.”

The IEA predicts that the percentage of power assets run on fossil fuels in the region will increase to around 80% by 2040.

Government policies

Though some Southeast Asian governments have introduced policies to support the deployment of renewable energy they are simultaneously encouraging the development of non-renewable power by providing those technology types with subsidies. The problem is that these subsidies are needed to keep electricity prices affordable to the poor.

Ric O’Connell, international director of renewable energy at Black & Veatch, told IJGlobal that a lot will depend on whether the region’s solar regulations and incentives adapt, particularly if they encourage larger scale solar development which can better compete with hydrocarbon-fired power.

“Projects under 20MW will struggle to compete, and require subsidies and other government support.” O’Connell added, “Larger projects can stand financially on their own and will help build a sustainable market, less dependent on government subsidies.”

A project finance banker in Singapore also told IJGlobal that he expects financing volumes for traditional energy to continue to increase in the next few years due to strong government support behind them.

Asean countries such as Thailand, Malaysia and Indonesia have made progress in their renewable energy policies, but implementation has either failed or been delayed. Subsidies continue to distort energy markets and prevent investment in renewables.

Positive signs

Asean countries could be turning a new page however.

Indonesia and Vietnam are looking to join Thailand in being leaders in solar power in Southeast Asia. Both Vietnam and Indonesia have introduced targets to expand green energy generation as a major global agreement to curb pollution is set to take effect this week.

Annual solar power production in the region will expand to 13GW in 2025 from around 1.6GW in 2014 under a business as usual scenario, the International Renewable Energy Agency (IRENA) has said.

If countries adopt the right allocation of support policies and targets, solar could grow to about 55GW by 2025, or an addition of roughly 5GW per year between 2014 and 2025, IRENA said.

We will have to see if Asean countries can pull their support together to allow renewable energy investment to rebound to its 2014 levels or higher.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.