A glut of LNG export projects

The cost overrun figures quoted for Australian LNG projects this week were startling. Chevron has admitted that the Wheatstone LNG project 12km off the coast of Western Australia, which reached financial close in 2011, has clocked up $5 billion in cost overruns to date. This brings the total capital expenditure overruns for Australian LNG projects in the last decade just shy of $50 billion.

Not all LNG projects in Australian are over budget. The sponsors of APLNG, which reached close in 2012, also released a project update this week stating that 60% of its completion guarantees have been released due to financing milestones being met. This is very good news for APLNG, as market conditions are making any additional costs particularly painful for sponsors.

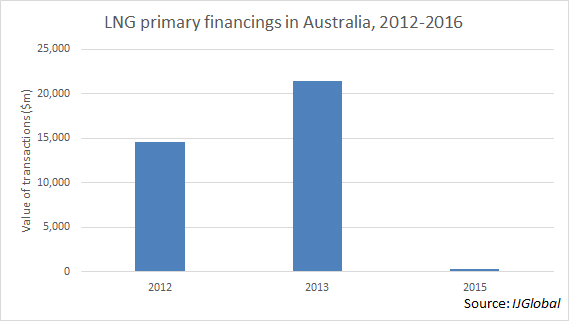

An abundance of supply and depressed oil prices have kept natural gas prices low over the last two years. The sharp fall in Brent crude at the end of 2015 led to many major LNG projects being shelved as revenue assumptions required serious revision. Australia had already vastly reduced its investment levels into new projects, after $35 billion of primary financings reached financial close between 2012 and 2013. With those and other projects now coming online the country looks set to overtake Qatar as the biggest LNG exporter globally.

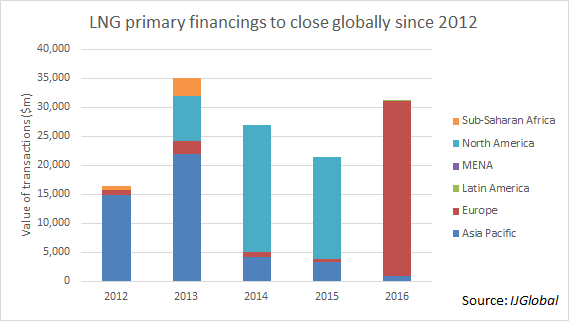

Primary financings for new LNG facilities worldwide peaked in 2013 and had been declining ever since. This year will see an end to that trend, though the spike in investment levels is almost entirely accounted for by one project, the roughly $30 billion Yamal LNG in Russia. And this transaction is not representative of the wider market. It has been many years in procurement, was significantly delayed by international sanctions imposed on Russia, and was only finally financed with investment from Chinese stated-owned lenders.

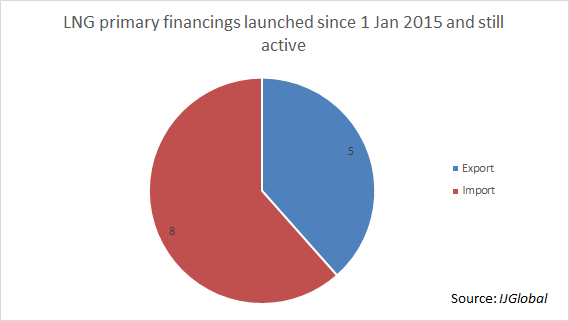

Given the availability of cheap gas, it is perhaps to be expected that the number of import terminal financings launched over the last two years globally has been greater than the number export facility transactions. Morocco, Thailand, Pakistan, Uruguay, Ghana, India and Bermuda are all looking to build new import infrastructure to take advantage of cheap gas prices.

But there are also several new liquefaction projects in development, most notably in North America and Indonesia, and so the LNG export market could yet get more competitive.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.