Indonesian procurement: signs of improvement?

When the 2,000MW Java 7 coal-fired power project reached financial close at the end of September 2016 it gave a major boost to the Indonesian power sector, which has seen a scarcity of completed transactions in recent years.

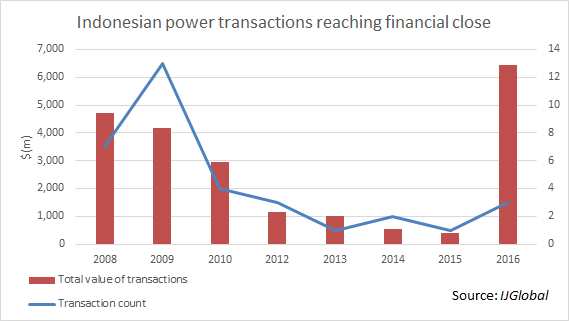

Successive Indonesian governments have set out plans for large scale power plant construction, but both Joko ‘Jokowi’ Widodo and his predecessor as President Susilo Bambang Yudhoyono have laboured to turn words into actions. The annual total value of power transactions reaching financial close in Indonesia between 2008 and 2015 actually fell each year, according to IJGlobal data.

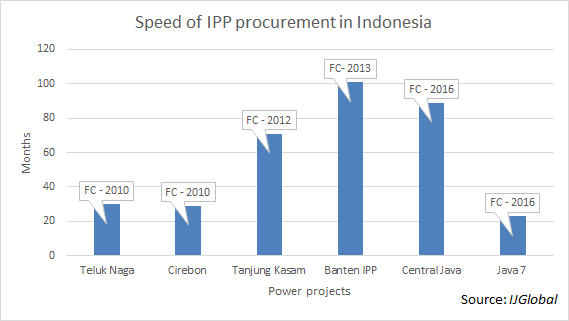

Java 7 was significant not just for its size (its $1.8 billion in debt significantly boosted transaction volumes for 2016) but also its speed of procurement. The project took just 23 months from launch to financial close.

This is a significant improvement on the period from early stage procurement to financing completion for other recent projects. Project sponsors are well-used to project timelines being extended and deadline being delayed in the country. The 2,000MW Central Java coal-fired plant, the only other greenfield financing to close this year, took 89 months to move from early stage procurement to financial close.

President Jokowi has set a target of installing 35,000MW of new power generation capacity by 2019, but state utility and procurement agency PLN has been straining under the burden of managing this process. But could the relatively speedy procurement of Java 7 be a sign that the situation is improving?

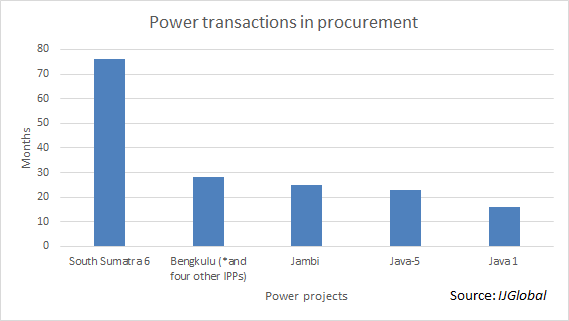

The total length of procurement for the 600MW coal-fired South Sumatra 6 is already well over international standards, and it is approaching 30 months since the tender for the 200MW Bengkulu and five other coal-fired projects were launched. But if other transactions in Indonesia’s pipeline are concluded quickly, it could help to improve the country’s reputation for procurement both regionally and globally.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.