Q3 league tables: Winners and losers

Wider trends in the infrastructure market can be perceived by taking a closer look at the league table performance of certain companies. IJGlobal has highlighted three companies whose IJGlobal Q3 2016 league table rankings reveal these trends.

The one section of infrastructure finance which has been livelier than most in recent quarters is the bond market. IJGlobal data shows a dip in capital markets activity linked to infrastructure projects in Q3 but there was still close to $4 billion of transactions closed.

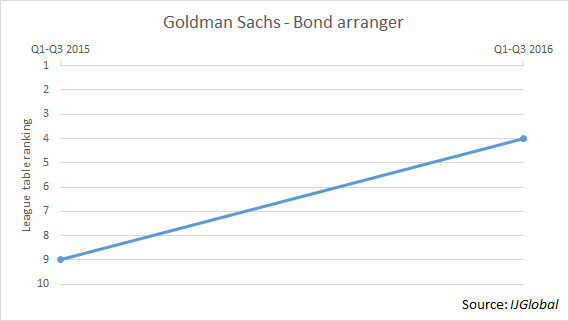

One company that has taken advantage of this increase in bond volumes is Goldman Sachs, which ranked ninth for bond arrangers of project finance transactions in Q3 2015 but has risen to four this year. By the end of Q3 2015 the company had arranged just three PF bonds with a combined value of $694 million, while in the first nine months of 2016 it had arranged eight deals worth $1.2 billion.

While Goldman Sachs is evidently having a strong year, its rise in activity is indicative of wider market activity. While no firm had closed more than eight PF bond deals in the first three quarters last year, three companies (RBC, Barclays and Crédit Agricole) have closed 10 or more deals this year.

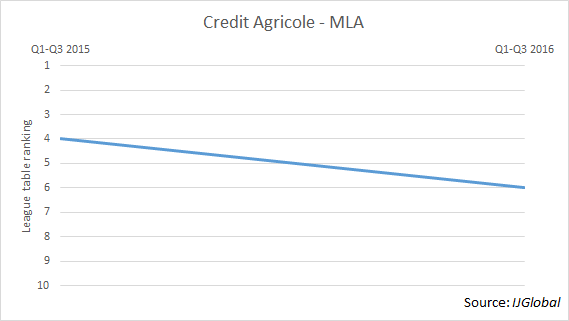

In the global project finance MLA tables, Crédit Agricole has slipped slightly from fourth last year to sixth this year. Although its ranking has not fallen sharply, the number of transactions it has lent on has. It has been a MLA on 37 closed PF transactions this year, whereas by the end of Q3 in 2015 it had closed 57.

This pattern of relatively little movement in ranking but significant reduction in activity applies to several other banks in the MLA top 10. Part of the reason for this appears to be MUFG’s dominance of the market this year. The bank has closed a dozen more PF deals in 2016 than it had by 30 September last year, and is 20 deals ahead of its nearest competitor.

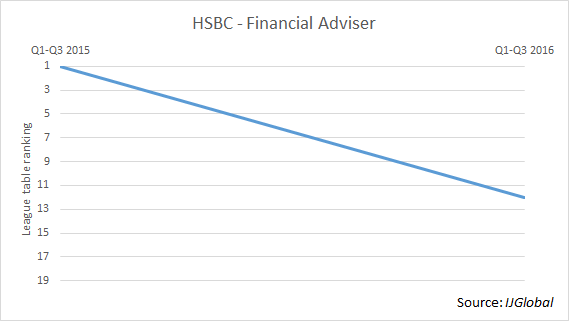

In the financial adviser tables, HSBC has fallen out of the top 10 in the latest league tables having topped them at this point last year. Several senior members of HSBC’s project finance team have left the bank in 2016, including its global head, and its year-to-date performance does suggest at least a partial retreat from the market.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.