Data Analysis: Deutsche Bank blues

The dramatic fall in Deutsche Bank’s share price at the beginning of this week cast a shadow over the future of the German bank. Local press reports speculate that German Chancellor Angela Merkel will not allow a bailout of the beleaguered business before government elections next year, though DB has in turn claimed that it will not need one.

The bank has been buffeted by ultra-low interest rates, high competition, regulatory pressures and, most recently, litigation charges. The US Department of Justice is seeking $14 billion from the bank to settle allegations of mis-selling mortgage securities. DB, which has a total market capitalisation of roughly $18 billion, says the final settlement will be significantly lower.

Though infrastructure is only a small part of the bank’s overall business, DB is a big lender in the infrastructure finance market.

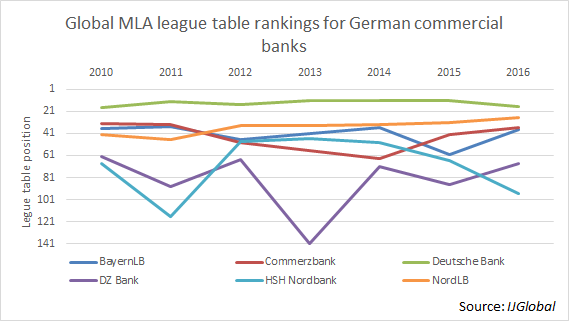

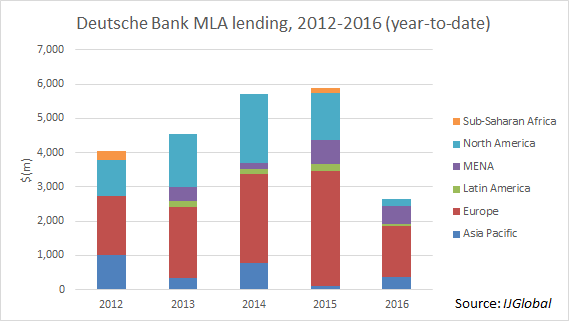

In IJGlobal league tables for the year-to-date (up to 26 September 2016), Deutsche Bank is 17th out of all mandated lead arrangers globally in terms of lending. The last time it finished a full-year in such a low position was in 2010 when it finished 18th, and each of the last three years it has finished 11th. It is by far the most dominant German bank in the market, with its closest challenger NordLB closing $2.76 billion in lending during 2015 compared to its $5.88 billion.

But its activity seems to have declined sharply this year. Although there are more than three months to go until the year-end, it looks likely that the number of deals for which it has acted as MLA and the total value of those transactions will both be down considerably from 2015. Its lending volumes at present are similar to those seen in 2012, but that year it was MLA on 45 deals compared to this year’s 27.

Until this year, the total value of DB lending had been growing and its exposure was becoming more spread between regions and sectors. While the majority of its infrastructure lending has consistently been targeted at the power, renewables and oil and gas sectors, other asset types such as transport, water and social and defence projects had gained a greater share by 2015. Geographically the bank had also focused more on projects in Latin America, the Middle East and Africa while continuing to support its core European market.

No one is yet predicting the demise of Deutsche Bank but the infrastructure sector is no stranger to collapsing German giants. In 2010, just two years before it ceased to exist, WestLB came 11th in our year-end MLA league tables. Deutsche Bank finished 72nd that year.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.