Japanese banks in the UK

Nobuyuki Hirano, CEO of Mitsubishi UFJ Financial Group (MUFG), warned British negotiators to engineer a ‘soft Brexit’ this week, raising fears again that major Japanese corporates could move their European headquarters away from London following the UK’s exit from the EU. Amsterdam, Paris and Frankfurt have all been mooted as possible destinations.

This speculation led IJGlobal to consider how important the UK infrastructure market remains to the big Japanese banks. Investment into the UK by these institutions is unlikely to be impacted much by a change of headquarters, but it is interesting to consider how busy its London-based infrastructure bankers are being kept by their domestic market.

And it seems while these banks may be raising the prospect of physically moving away from the UK, Japanese bank debt is heading towards the country’s infrastructure at greater volumes than ever.

The total value of project finance debt into UK infrastructure has declined somewhat recently, according to IJGlobal data. While 2014’s roughly $49 billion of closed project finance transactions in the UK was the highest yearly total in five years, 2015 hit just $37 billion and with almost nine months of the year gone 2016 has recorded just $17 billion of closed transactions.

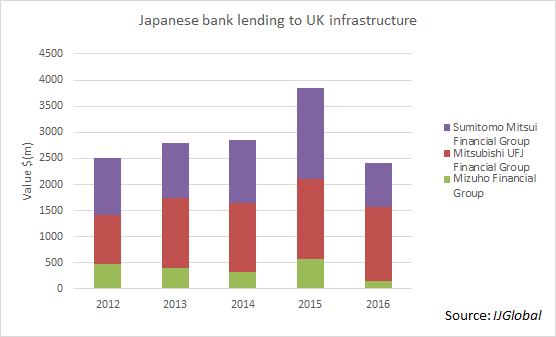

However, lending by the three largest Japanese banks (MUFG, SMBC and Mizuho) to UK infrastructure actually grew significantly to total a combined $3.86 billion in 2015 from $2.84 billion the previous year. These figures represent corporate finance as well as project finance transactions.

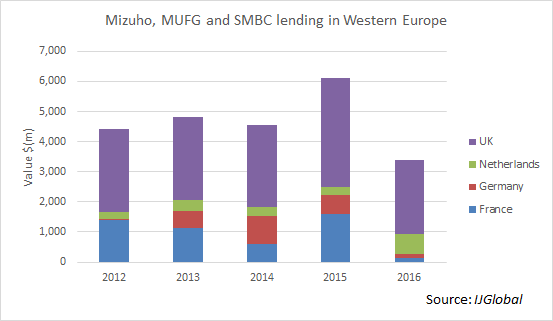

While total debt provided by these three banks to UK infrastructure projects looks set to be lower in 2016, the vast majority of their lending in Western Europe is provided to UK projects. Their lending to UK projects has been greater than the combined total lent to projects in the Netherlands, Germany and France in each of the last five years.

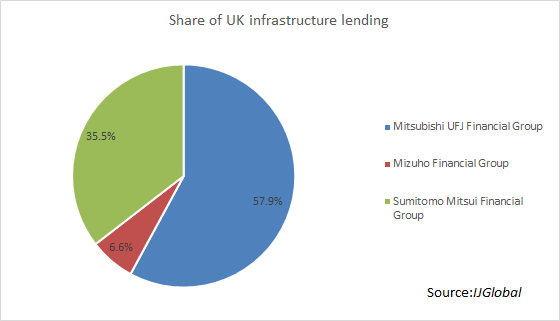

According to the latest IJGlobal league tables, MUFG has been the dominant Japanese lender in the UK market in the year-to-date (as of 21 September 2016). MUFG has provided over half of the total debt provided by the three banks, whereas the lending volumes of itself and SMBC were much closer over the preceding three years, 44.3% and 42.3% of the three-bank total, respectively.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.