Asian investors eye UK nuclear

Rumours this week of potential Korean investment in the £10 billion ($13.26 billion) Moorside nuclear project in Cumbria, UK, means that this development now appears to have more momentum than the country’s controversial and stalled Hinkley Point C project in Somerset.

South Korea’s Electric Power Corporation is understood to be in talks to join Moorside’s NuGen sponsor consortium, which already includes Japan’s Toshiba and France’s Engie.

Any new UK nuclear power project would be the first in the country in over 20 years, and Asian investors look pivotal to the country’s nuclear ambitions.

According to IJGlobal data, there are three nuclear projects in procurement in the UK; Moorside, Hinkley and Wylfa Newydd Nuclear Power Plant in Wales. All three have Asian sponsors.

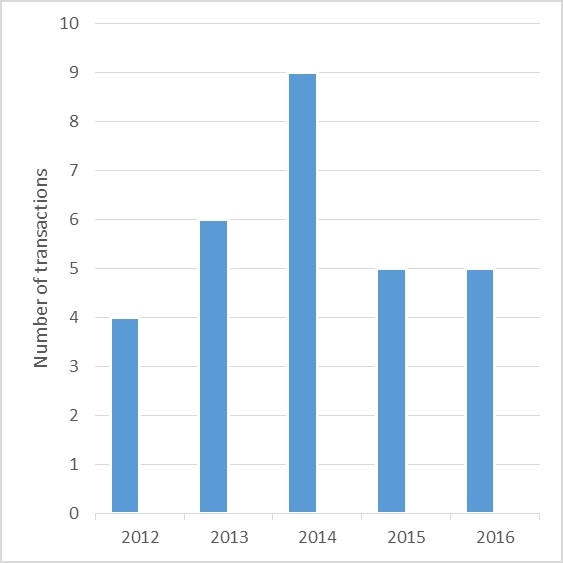

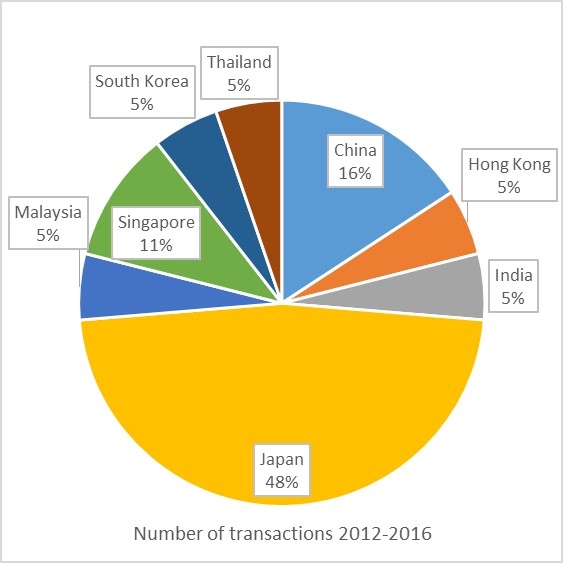

Though the heavy reliance on Chinese investment for the Hinkley Point C project has proved controversial, Asian investors are very much a mainstay of the UK energy market. According to data from IJGlobal, the number of energy transactions with Asian sponsors has been consistent over the past five years.

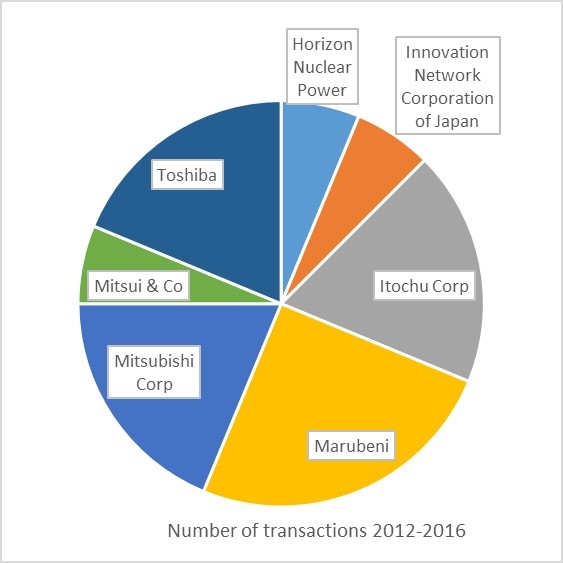

Japanese investors have been the most prolific, often bringing with them EPC expertise and guaranteed debt financing from Japanese banks. Japan Atomic Power Company was named as technical adviser on the Wylfa Newydd nuclear project. Mitsubishi last year refinanced the debt on its Walney I Offshore Wind Transmission Line Acquisition. Japanese bank Mizuho was a lender.

Japanese developers, Marubeni, Itochu, Toshiba and Mitsubishi have been very active in the UK, investing mainly in offshore wind, OFTOs, biomass and nuclear.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.