Major oil and gas sell down

Oil and gas major Royal Dutch Shell last week reached an agreement to dispose of its interest in several blocks in the Gulf of Mexico Green Canyon. The deal is the latest in a long line of divestments from Shell, which is looking to raise $30 billion from the disposal of assets by the end of 2018.

It is not the only oil and gas company trying to sell off assets to raise capital. Majors have continued to implement critical disposal programmes for non-core assets, prompted by the sustained drop in oil prices. In Africa, Italy’s Eni is in talks to sell 20% of its Zohr gas field off the coast of Egypt, after saying in April that it needs to cut jobs in its Egyptian Upstream unit due to low oil prices.

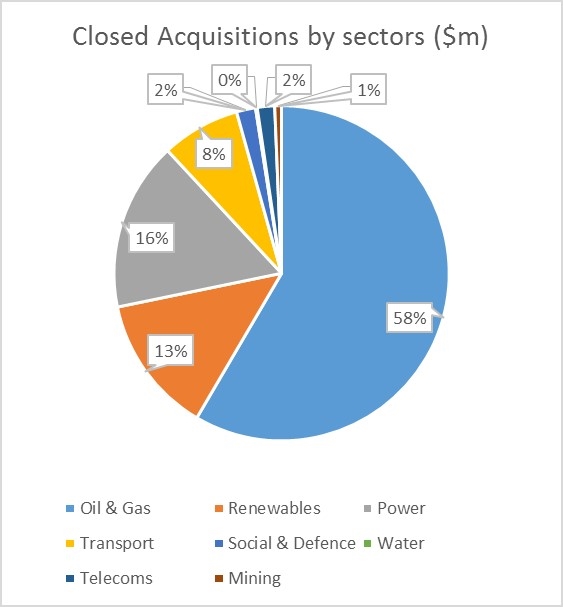

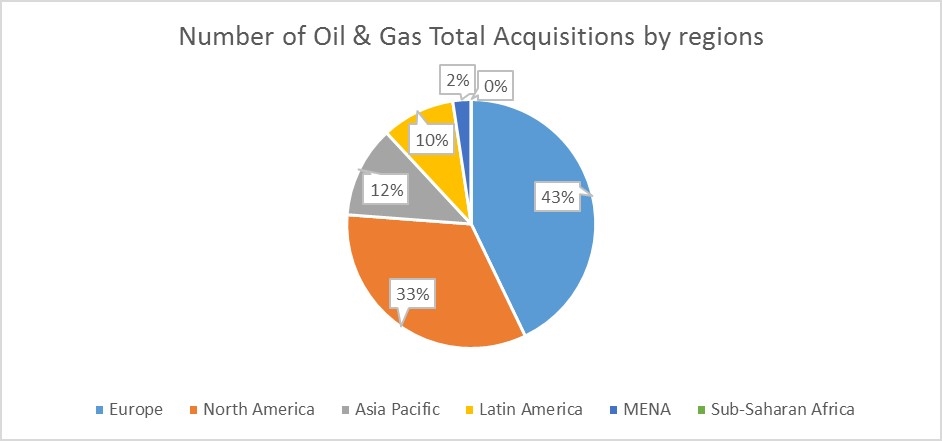

According to IJGlobal data there were eight M&A deals in the financing stage in the upstream oil and gas sector in August 2016. IJGlobal’s data for 2016 so far has shown that for energy and infrastructure acquisitions, the oil and gas sector represented the highest total volume. The value of closed oil and gas deals globally came to $85.22 billion, spread across 42 deals.

The swathe of asset sales from major oil and gas developers marks a shift in the ownership of assets from global conglomerates to smaller, more focused, regional developers. Shell sold its Gulf of Mexico assets to Houston based oil and gas company EnVen Energy, which focuses on Gulf of Mexico development. Last month Cypriot energy firm Energean Oil & Gas acquired Delek Group’s 100% stake in the Tanin and Karish gas fields.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.