Data Analysis: Chinese takeover

Chinese investors were this week left bemused by the actions of the Australian treasurer when their bids to buy electricity distribution network AusGrid were prohibited. Scott Morrison, MP blocked the sale citing national security concerns.

The final two bidders in the process, both Chinese, have understandably found it difficult to rationalise the decision. It could be argued that the Australian Foreign Investment Review Board (FIRB), which recommended that the sale be stopped, is behaving somewhat melodramatically. Or perhaps they are cautious of a perceived wider takeover of the Australian electricity and distribution market by Chinese investors?

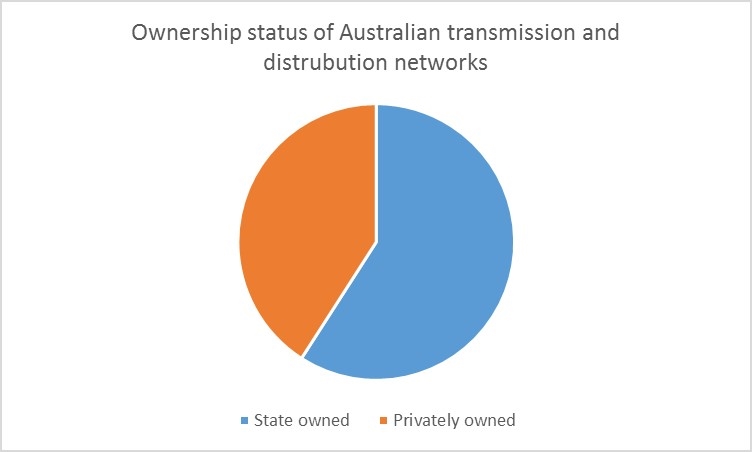

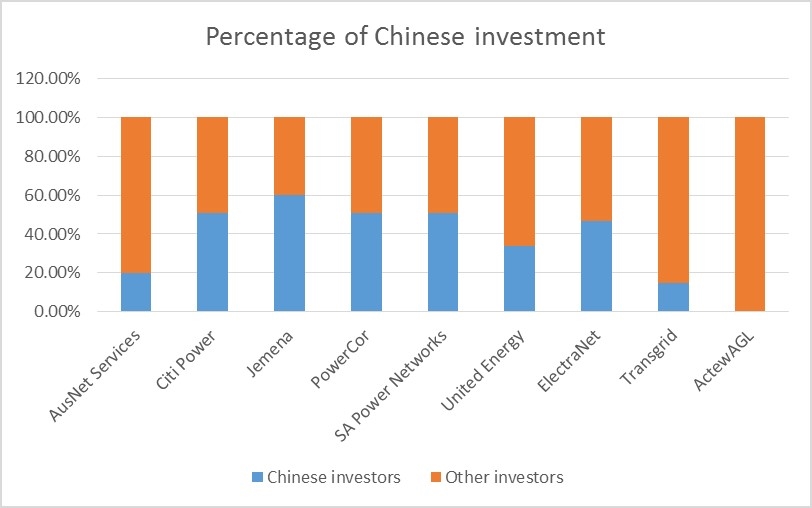

Of the 22 regional transmission and distribution companies in Australia, 13 are still state owned and nine are privately owned. Of those nine privatised companies, eight are at least partly owned by investors based in either mainland China or Hong Kong. All of the investment comes from the same two companies involved in the AusGrid privatisation; State Grid Corporation of China, and Cheung Kong Infrastructure (CKI).

The Chinese shareholders hold majority stakes in four of the networks – Citi Power, PowerCor, SA Power Networks, and Jemena. According to IJGlobal data CKI were also part of the sponsor consortium on two primary transmission deals in Australia; Arrat Wind Farm Transmission in 2015, and the Mount Mercer Transmission Line in 2013.

However this interest in Australian assets does not extend further than transmission. Despite the rapid increase in M&A activity in Australia since 2013, according to IJGlobal data, in 2015/16 only one M&A deal in Australia featured a Chinese investor as part of the bidding consortium; China’s State Power Investment Corporation investment in the Taralga Wind Farm.

The activity of StateGrid and CKI appears not to be an attempt to take over the Australian network but rather a continuation of their investment strategy. CKI have made similar investments in Europe. Meanwhile StateGrid have made several transmission investments in Brazil, and also in Europe.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.