Data Analysis: Australia's privatisation record

The federal government's surprise decision last week to block two binding bids for the sale of AusGrid is a reminder that Australia's privatisation programme, the world's largest in terms of the total value of transactions, is not immune from political risk.

Although the $9.2 billion AusGrid deal may have been delayed, Australia can still boast an extensive track record and pipeline of asset sales that makes it the biggest privatisation market in the world.

Global leader

Australia has been a global leader in selling state-owned assets, both in terms of transaction values and number of deals over the last 10 years, IJGlobal data shows. Since the privatisation of the Mount Isa and Townsville airports in Queensland in 2005, the country has completed 11 more privatisations.

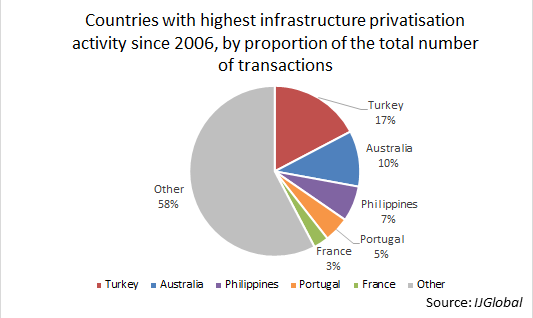

In terms of the total number of state-owned infrastructure assets privatised by all countries around the world since 1 January 2006, Australia comes second only to Turkey, which has offloaded 22 assets. The total number of infrastructure privatisations closed globally in this period is 107.

Australia's strategy has been to use the capital raised through these major privatisations to plug the public funding gap created by a commodities downturn. This asset recycling has allowed the government to support numerous new transport infrastructure projects in the country.

With a string of multi-billion dollar public transport works to be paid for, state governments have been auctioning off the concessions to operate several major ports and "poles and wires" electricity transmission networks. These major deals have included the $2.2 billion Port of Brisbane sale in 2010 and last year's $7.7 billion concession to operate New South Wales' TransGrid electricity transmission network.

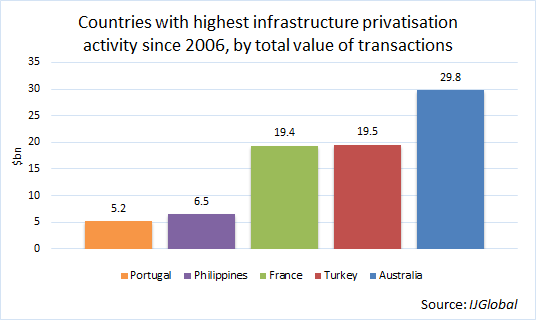

The ticket sizes for many of Australia's recent asset sales have been considerable, meaning that in terms of total value of transactions the country is by far the global leader. Australia has raised just shy of $30 billion through disposals since the beginning of 2006, which is more than $10 billion above the total raised by Turkey.

Political speed bumps

Privatisations are always politically sensitive however and last week's decision to block the AusGrid deal demonstrates the political sensitivities concerning Australia's disposal programme. Federal state treasurer Scott Morrison blocked the two binding bids for AusGrid submitted by State Grid Corporation of China and Hong Kong-based Cheung Kong Infrastructure (CKI) because of unspecified "national security" concerns.

The timing of the decision, which came just two weeks after the New South Wales government accepted the binding bids, has prompted a lively debate about how politicians should manage the sale of state assets.

The opposition Labor Party, which has historically opposed the privatisation of "poles and wires", is demanding the federal government come up with a list of infrastructure assets that cannot be sold for national security reasons to foreign investors. "You have the debate before an individual proposal comes along," Labor frontbencher Stephen Conroy told the local press.

With the government remaining vague about what the national security concerns are, the issue of why the bids were rejected is unlikely to go away.

The most widely accepted theory - that Morrison rejected the two bids because of their ties to Beijing - may be plausible for State Grid, which is state-owned and operates most of China's electricity transmission network. But it would not explain why the rival bid from CKI, which is controlled by Hong Kong billionaire Li Ka-shing, was also spiked.

Either way, the AusGrid sale is expected to proceed at a later date and perhaps on slightly different terms, and at lower prices now the highest bidders have been ruled out of the race.

As IJGlobal previously reported, State Grid and CKI are understood to have prepared bids of between A$10 billion ($7.7 billion) to A$14 billion, prompting other potential buyers to drop out before submitting any binding bids.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.