Data Analysis: Brazil's ailing infrastructure sector

Investment into Brazilian infrastructure has been hindered by a tough recession and the sprawling Petrobras corruption scandal, which has led to the worst political crisis in Brazil’s recent history.

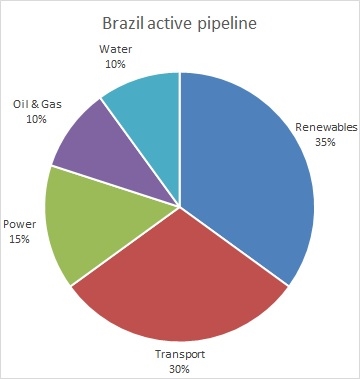

Brazil’s burgeoning renewable energy market has proven to be a bright spot against this gloomy backdrop. But deal flow in this sector also looks headed for a slowdown.

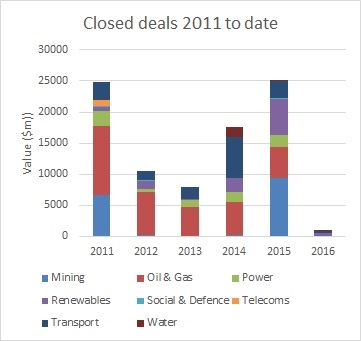

According to IJGlobal’s data sample, while the overall value of investment into infrastructure rose in 2015, a significant chunk of this corresponds to one particular deal: Vale, Dongkuk and Posco’s CSP steel mill project in Ceará state.

Despite numerous attempts to jump start desperately needed investment into the transport sector, IJGlobal data shows that this sector’s share of closed deals fell during 2015.

The federal government unveiled a new logistics investment programme in mid-2015 which essentially repackaged some previously announced concessions that had failed to get off the ground.

But construction firms embroiled in the so-called lava-jato investigation and under pressure from the recession have been left heavily leveraged. This has prompted a wave of M&A activity under which infrastructure assets have changed hands.

State-owned oil and gas company Petrobras has also announced a major divestment programme, but the process has suffered delays.

While 2015 saw a couple of sizeable oil & gas deals close – including the Saquarema and Libra FPSO transactions – the once booming industry has been battered by both the drop in oil price and corruption scandal.

The collapse of the Sete Brasil project is perhaps most emblematic of the troubled sector. The project was launched in 2010 to build 28 oil rigs to be leased to financially stricken Petrobras. The deal was massively scaled back earlier in 2016, and the company has since requested bankruptcy protection.

By contrast Brazil’s wind and solar photovoltaic (PV) sectors have demonstrated strong growth in the last few years. Transactions backing renewable assets accounted for 39 of the 66 closed deals in IJGlobal’s sample for 2015. The growth of this sector has been driven by government power auctions.

But the consequences of the economic downturn have begun to impact the development of some recently awarded wind and solar projects. In the tougher climate, developers have been met with less available finance from national development bank BNDES (the country’s main source of funding for renewables) and the depreciation of the Real has pushed up project costs.

There is also concern over falling demand levels. A recent renewables auction was cancelled and a second has been postponed until December 2016.

It is against this backdrop that the government's hosting of the 2016 Olympics and the extensive investment into games-related infrastructure has been opposed by some that point to the country’s vast social infrastructure deficit and growing levels of crime and unemployment.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.