Bronze for Brazil

As Rio welcomes the 2016 Olympics, opinions are divided as to the real cost of hosting this year’s games for Brazil. The event has been marred by budget overruns, construction delays and health concerns over the spread of the Zika virus.

Having been hit hard by recession and the sprawling Petrobras corruption scandal, which has led to the worst political crisis in Brazil’s recent history, the economy is in bad shape.

The extensive investment into games-related infrastructure is opposed by some that point to the country’s vast social infrastructure deficit and growing levels of crime and unemployment.

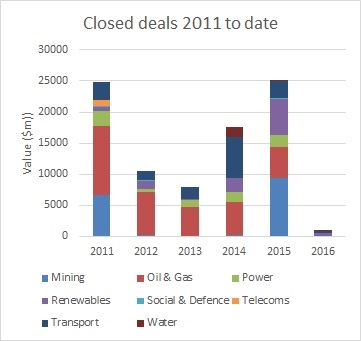

According to IJGlobal’s data sample, while the overall value of investment into infrastructure rose in 2015, a significant chunk of this corresponds to one deal: the CSP steel mill project in Ceará.

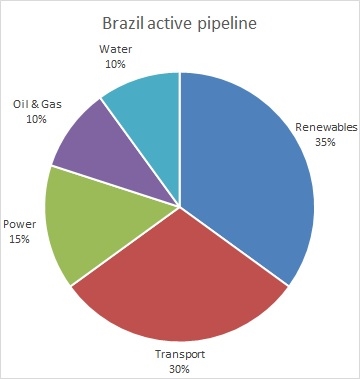

Despite numerous attempts to jumpstart desperately needed investment into the transport sector, IJGlobal data shows that this sector’s share of closed deals fell during 2015.

Construction firms entangled in the so-called lava-jato investigation and under pressure from the recession have been left heavily leveraged. This has prompted a wave of M&A activity.

While 2015 saw a couple of large oil & gas deals close – including the Saquarema and Libra FPSO transactions – the once booming industry has been battered by both the drop in oil price and corruption scandal.

Brazil’s renewable energy market has proven to be a bright spot. Transactions backing renewable assets accounted for 39 of the 66 closed deals in IJGlobal’s sample for 2015.

Activity in this sector, though, could be slower during 2016. The economic downturn has affected the implementation of some projects.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.