Fund analysis: Mirova-Eurofideme 3

On 5 July 2016 Natixis’ socially responsible investment arm Mirova reached final close on Mirova-Eurofideme 3, its third generation renewable energy fund, at €350 million ($390.8 million).

The fund manager significantly surpassed the €200 million target it set at the fund's launch in 2014. Managing director Raphael Lance told IJGlobal it could have raised more capital, but decided to turn a couple of investors down. Prior to final close, the fund made a first small close at €85 million in 2014.

Mirova-Eurofideme 3 is a closed-ended fund, which invests in partnerships, mezzanine debt and equity, primarily in greenfield assets in Europe.

A high demand for renewables assets from institutional investors in Europe coupled with a rich pipeline of deals would suggest that the majority of fund managers would be looking to raise large funds and invest big tickets. However, for Mirova-Eurofideme 3, contained fundraising was the best option.

Lance said: “Mirova-Eurofideme 2 attracted investment of €100 million and at the time of launch of this fund we thought we were ready to raise double that and set the target at €200 million. As we continued fundraising, we received increasing investor interest and raised the target first to €250 million and then to €300 million. However, as we target individual asset deals, we decided that we wouldn’t go above that threshold more than by 10%.

"Our greenfield focus also means that the average tickets of our deals are between €10-20 million, but that’s where we see value and we want to remain focused.”

Building projects from scratch is, in the manager’s opinion, the best way to create value for investors. “We are not buy and hold investors. On the contrary, we take quite an opportunistic approach to buy an asset and exit the investment after a few years,” he adds.

Investor spread

For the latest fund, commitments came from existing investors in Mirova's two previous funds as well as new investors and included 30 institutional investors across Europe. The only public investment was made by the European Investment Bank (EIB), which invested €40 million in January 2015.

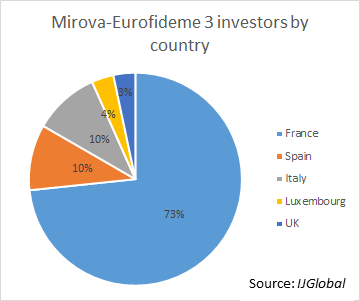

Mirova-Eurofideme 3 predominantly attracted French investors and insurance companies. France is a good spot for Mirova. Lance said: “Unlike other countries in Europe, especially the UK, French institutional investors have a lower portfolio weighting on infrastructure, which makes it a very valuable market for us to invest in."

Outside of France, the fund attracted commitments from Italy, Spain, Luxembourg and the UK in equal proportion.

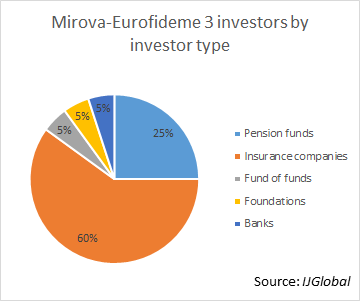

The vast majority of the fund's investment (60%) came from insurance companies, while a quarter of total commitments came from pension funds from across Europe. The remaining 15% is equally distributed among funds of funds, foundations and banks.

Interest in infrastructure and specifically renewable energy from European institional investors will continue, according to Lance. “The low interest rate environment and the implementation of regulations like Solvency II have driven investment towards infrastructure in general recently. Renewables in particular has become a more mature asset class from a risk standpoint, especially in the electricity market, and is no longer perceived as a subsidy industry,” he said

Investments to date

Mirova-Eurofideme 3 has made 10 investments to date totalling close to €100 million in partnership with independent power producers and developers. These investments have financed more than 300MW of solar, wind and hydro projects across France and the Nordics.

Wind power assets make up the majority of the fund's portfolio.

The 10 investments to date are:

- 20MW Langmarken onshore wind project in Sweden

- A majority stake in the Våsberget 27.6MW wind farm in Sweden

- A majority of the Terres Froides 10MW wind farm in France

- A subordinated debt investment in a 160MW wind and hydro portfolio with assets in Poland, Portugal, Croatia and France

- A solar plant in France

- A wind farm in France

- The acquisition financing of 30MW onshore wind farm Monts de Lacaune in south France

- Financing for the acquisition of a 9MW solar plant in Guadeloupe

- Financing for the acquisition of solar in Corsica

- A further unspecified wind farm investment

The fund is planning to make between 20 and 35 investments between €5 million and €30 million until the end of its official investment period in 2019.

Mirova seeks high single digit returns and a 5% yield rate annually.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.