Data Analysis: Omani water demand spurs developer opportunities

Oman’s government is anticipating ever-growing demand for potable water in the region and seems well placed to deliver it. A series of successful financial closes on independent water producer (IWP) projects in recent years, combined with a strong pipeline of tender opportunities, bode well for developers and investors.

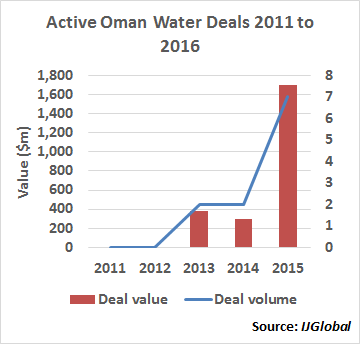

The number of active water sector deals in the market has been rising over the past five years, with 2015 in particular being a bumper year with just under $1.7 billion of active deals out in the market in the nine months to 1 August 2016.

The Oman Power and Water Procurement Company (OPWP) forecasts developing additional water capacity of at least 822,000 cubic metres per day (cmpd) throughout the country through to 2022. OPWP is aiming to meet considerable growth in demand for potable water through the procurements; in the northern region of the country demand is projected to increase by about 6% per year through to 2020. In the south, demand in the Salalah region is projected to grow at 8% per year.

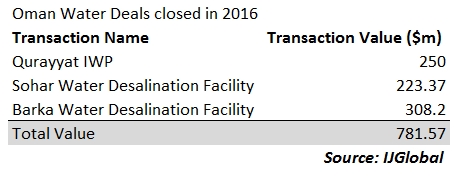

Some $781 million of water deals have closed in 2016 to date, including Qurayyat, Barka and Sohar. The $250 million Qurayyat independent water producer (IWP) reached financial close in 2016 after sponsor Hyflux signed on $185 million in debt in December 2015. Sohar and Barka were procured simultaneously but were won and developed by separate consortia, with both IWPs reaching financial towards the middle of 2016.

And there are more being tendered. OPWP prequalified eight consortia for the Salalah and Sharqiyah IWPs in March this year, and issued a request for proposals for the Salalah IWP to seven bidders in April this year. The 80,000 cmpd and 100,000 cmpd projects, respectively, are expected to come online in 2018 and 2019.

Upcoming projects

OPWP is expecting to tender a number of other water projects before the year is out. OPWP’s seven-year statement from 2016 to 2022 – released in July this year – laid out the country’s anticipated water (and power) tenders over the coming years.

In 2016 OPWP plans to:

- Issue tender documents for up to 100,000 cmpd per day of mobile water desalination capacity. OPWP invited expressions of interest for suppliers of the units earlier this year.

- Issue tender documents for Salalah 3, a 100,000 cmpd desalination plant planned for operations in 2021.

- Procure a new 16,000 cmpd IWP at Khasab in Musandam for service in 2020.

- Procure the 60,000 cmpd Duqm plant also for service in 2020.

The authority also plans to finish its development of a new procurement methodology allowing plants approaching contract expiration to compete for new long-term power purchase agreement or power and water purchase agreement contracts, according to OPWP’s seven-year outlook statement.

OPWP could also tender its Salalah 4 IWP in 2016 after the above procurement processes have been initiated. Salalah 4 is planned to have 100,000 cmpd capacity and to begin operations in 2021.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.