M&A bright spot

While IJGlobal’s league tables for H1 2016, published earlier this month, show an overall decline in the number and value of infrastructure transactions reaching financial close in the first half of this year, there are parts of the market growing. Along with the global infrastructure bond market, which grew to $15.82 billion in H1, M&A activity has also been high since the start of the year.

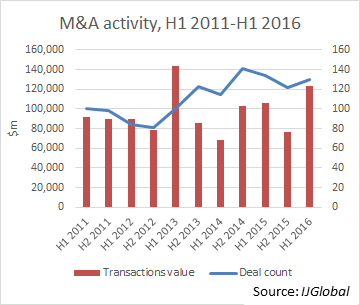

IJGlobal’s official league tables strip out company acquisitions in order to focus on transactions directly related to assets. But if you include acquisitions of energy and infrastructure companies, the M&A market saw an upturn in H1. Just under $124 billion of transactions closed in the period across 130 deals, while H2 2015 saw 122 deals close for a total value of roughly $76.5 billion.

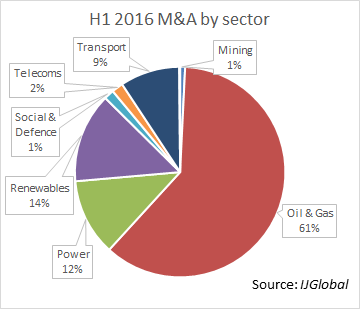

The total value of transactions was the highest since H1 2013, a performance significantly boosted by corporate acquisitions in the oil and gas sector, with the top five transactions all being O&G company acquisitions. The largest was the acquisition of BG Group by Royal Dutch Shell, followed by the acquisitions of Columbia Pipeline Group and AGL Resources.

This trend was caused by a continued depression of oil prices which saw major restructurings of balance sheets and a consolidation in the O&G sector. With brent crude hitting a three month low this week after a partial recovery, more sales of assets and businesses look likely.

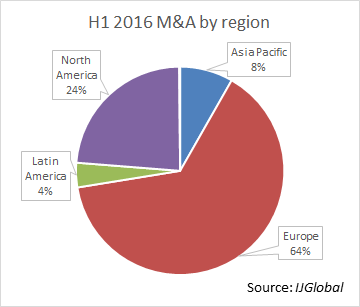

Stand-out project finance M&A deals during H1 included the $2.94 billion acquisition of the Chicago Skyway toll road in the US and the $2.31 billion privatisation of the Osaka and New Kansai International Airports in Japan. Despite these sizable deals, both energy and renewables were bigger sectors for M&A in the period than transport. The market for these assets only looks set to expand as the number of operational renewable energy assets globally continues to grow at an exponential rate and governments and major corporates pursue green policies.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.