Turkey following the failed coup

The extreme crackdown on opponents by Turkey’s president Recep Tayyip Erdogan following an attempted coup by the country’s army last week is a concern for investors as well as Turkey’s political allies. If the worst scenario is realised and Turkey slips into dictatorship amid violent street clashes, much needed investment into the country’s infrastructure will probably dry up.

Erdogan has always been a firm supporter of infrastructure development, and the stability brought by the majority rule of his AK Party had encouraged international investors to become increasingly active in Turkey. This trend is most noticeable in the country’s ambitious hospital PPP programme, which is in its second phase.

However, although Erdogan and his government survived the coup attempt, investor confidence has been shaken. Several sources close to the Turkish market now say that all but the largest projects in the country will grind to a halt until the full consequences of Erdogan’s purge can be assessed.

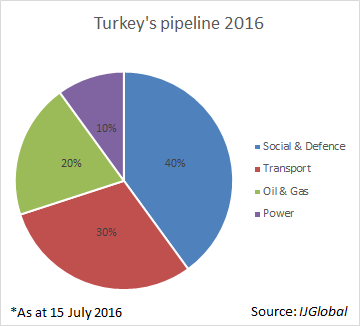

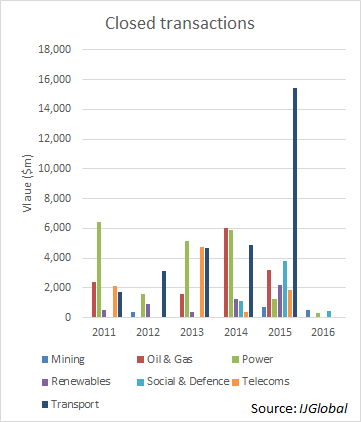

IJGlobal data suggests that the market had already been disrupted by the political uncertainty caused by the inconclusive general election in June 2015 and a proliferation of terrorist attacks connected to the ongoing conflict in neighbouring Syria. The pipeline of active project finance and corporate finance transactions in the country has declined from 17 to 10 since July 2015, and the volume of deals concluded this year has been very low.

This follows a strong 2015, where $28.47 billion of transactions reached financial close, up from $19.66 billion in the previous year. With more than half of 2016 over, just $1.29 billion of transactions have closed.

Transport was the stand-out sector for Turkey in 2015 with $15.46 billion of deals. Just two transactions however, the $6.5 billion Third Istanbul Airport and $6.3 billion third phase of the Gebze-Izmir toll road, account for much of that total. Perhaps more significantly the year also saw the highest total value of transactions in the renewables and social and defence sectors for five years.

While the Turkish government had been able to rely on local lenders for much of the financing requirement for infrastructure in the past, international investors were beginning to feel increasingly comfortable with Turkish projects. The worry is that this trend had begun to be reversed even before the coup attempt which has sent tremors through Turkish society.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.