Data analysis: North America beats Europe as fundraising focus

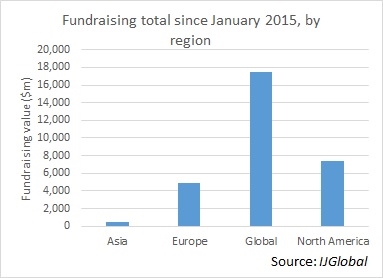

Fundraising activities for open-ended, unlisted infrastructure funds have been geared towards global opportunities in the past 18 months, with North America beating Europe as an investment destination for funds with a specific regional focus.

Since 1 January 2015 a total of $30.3 billion* has been raised by closed-ended, unlisted infrastructure funds which are actively deploying capital in the market, according to IJGlobal data. The figure refers to funds that have reached at least first close or made a first investment. Of the total, above $17.5 billion of commitments went into funds with a global mandate.

Among the funds in this category tracked by IJGlobal were Brookfield Infrastructure Fund III; DIF Infrastructure IV; iCON Infrastructure Partners III and QIC Global Infrastructure Fund.

Brookfield Infrastructure Fund III alone contributed to $14 billion of the total $17.5 billion being raised to target opportunities at a global level. The fund reached final close on its third infrastructure on 12 July 2016, largely surpassing its initial target size of $10 billion and doubling in size compared with its predecessor.

The Toronto-based fund manager attracted over 120 institutional investors, reportedly including New Mexico’s pension fund, Oregon Public Employees Retirement System, Maine Public Employees Retirement System, sovereign wealth funds, and Seoul-based Korea Teachers Pension and Public Officials Benefit Association (POBA).

A total $7.4 billion was raised to target opportunities in North America, with the largest amount being raised by Stonepeak Infrastructure Partners’ Fund II ($3.5 billion.) The funds raised to target assets in North America were almost double compared with the $4.8 billion being raised by fund targeting exclusively European infrastructure, with the biggest contribution coming from Meridiam Infrastructure Europe III which raised a total of $1.3 billion on its first and final close on 27 April 2016, four months after being launched.

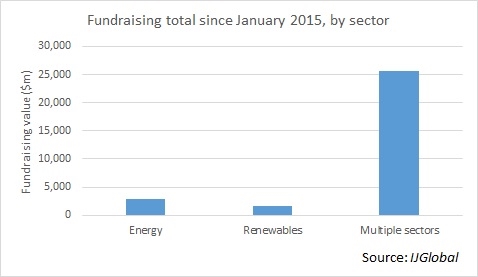

Sector-wise, fundraising activities over the past eighteen months have shown an interest in targeting multiple energy and infrastructure sectors.

Of the total $30.3 billion, $25.6 billion is target assets in sectors ranging from transport, energy, renewables, social infrastructure and telecoms. Around $3 billion and $1.7 billion were raised to exclusively target the energy and the renewables sectors, respectively.

Notable perhaps is the absence of any funds exclusively targeting only non-energy related assets. All of the funds in this selection which were targeting PPPs were also targeting energy or renewables assets. Energy (referring to conventional power and oil and gas) and renewables were the only sectors to have dedicated funds.

The largest fund in the market, Brookfield Infrastructure Fund III, has so far committed to invest over $3 billion in assets including a portfolio of US hydroelectric facilities; a portfolio of Brazilian electricity transmission projects; a Colombian power generation company; a portfolio of Peruvian toll roads and a US water infrastructure project developer.

(*Exchange rate as at 18 July 2016)

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.