Data Analysis: Sharp fall in US oil & gas volumes in H1

While tax credit extensions contributed to a general slowing of renewable sector financial closes in the first half of 2016, IJGlobal data shows that a weak oil price environment wreaked much havoc on the oil & gas space during the same period.

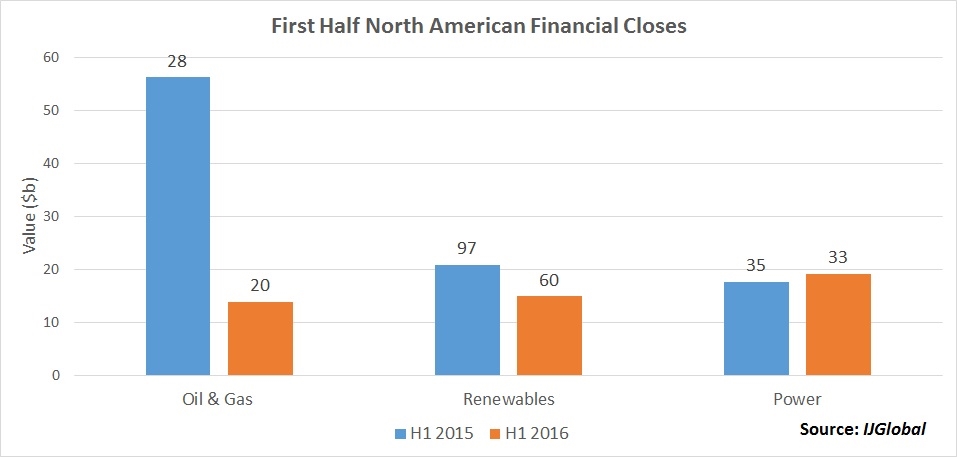

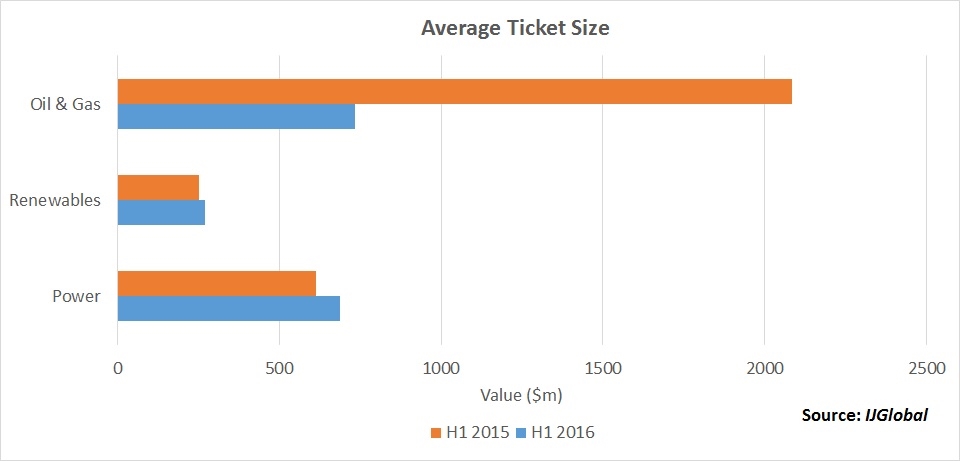

Through 20 closings in H1 2016, the oil & gas sector locked in $13.95 billion in financing with an average value of $734 million. This was down from a whopping $56,298 million in financings during the same six months last year through 28 closes with an average of $2.1 billion—equating to a 75.2% drop in total value and a 64.8% drop in average value to match a comparatively slim 29% drop in deal volume.

A further look shows that whereas project-level debt issued in the oil & gas space fell by 59% to $12.76 million from $31.16 billion in the halves, equity infusions were nearly completely halted with a 95.3% drop to $1.19 billion from $25.14 billion.

For comparison, the renewables sector saw a 61.9% drop in transaction volume year-on-year, yet total transaction value tapered by only 28.25% to $14.94 billion from $20.82 billion. Average ticket size during the period grow by 8.3% to $272 million from $251 million in H1 2015.

Despite two fewer financial closes year-on-year, the North American power sector grew by 8.4% to $19.28 billion from $17.78 billion in 2015’s first half, and average value grew by 12.2% to $688 million from $613 million in H1 2015.

While trepidation concerning oil price stability remains after the $27 per barrel February floor, industry experts at Galway Group came forward last week at the 4th Annual Americas Midstream Oil, Gas and LNG Infrastructure Finance Forum in Houston, Texas, to say they expect a slow climb up to $65 in the coming years with demand-related spikes to the high $80 range. On the same thread, JP Morgan analysts last week said they expect to see $65 oil by the end of 2017.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.