Data Analysis: Not easy being nuclear

The ongoing viability of the UK’s greenfield nuclear power projects is just one of many uncertainties thrown up by the UK’s decision to vote to exit the European Union. There is no guarantee that any new UK government will be supportive of the struggling Hinkley Point C development, and Hitachi, the developer of the planned 2.7GW Wylfa Newydd project in Wales, openly opposed Brexit before last week’s vote.

Market uncertainty has just made challenging financings that much tougher. Only four transactions raising private capital to support the construction of new nuclear power capacity have closed globally since 2009, according to IJGlobal data.

One of these transactions was a corporate loan raised by state-owned utility Saudi Electricity Company to support a whole range of conventional and renewable power developments, and Saudi Arabia is yet to build a nuclear power plant. The Grand Gulf transaction in the US, closed in 2009, has been the only deal which could be described as a project financing.

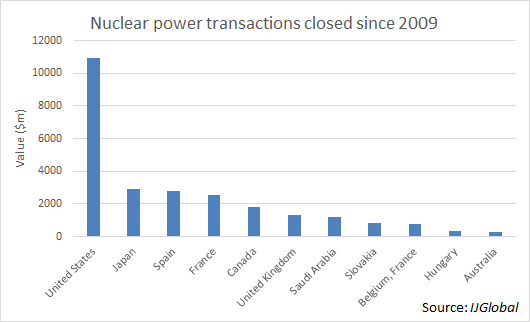

Private investment into nuclear has been concentrated in the US, though most of these deals have supported corporate acquisitions. ENEC planned a project financing for its Barakah project in the UAE, but a deal was never concluded.

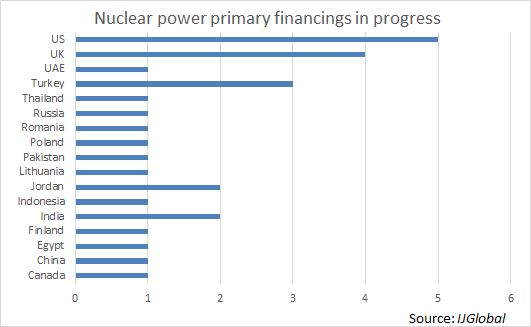

This lack of precedent has not dissuaded developers around the globe. IJGlobal data shows that 28 financings for greenfield nuclear projects are in progress. Other nuclear power developments have been mooted in countries such as South Africa, though these plans are still a long way away from a bankable project. Interest in nuclear power is growing, but delivering it is still devilishly hard.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.