Data Analysis: Honduran PV

Honduras has developed what is undoubtedly the most established solar market in Central America. A tariff incentive scheme introduced by the government in 2013 has proven attractive to local and international developers.

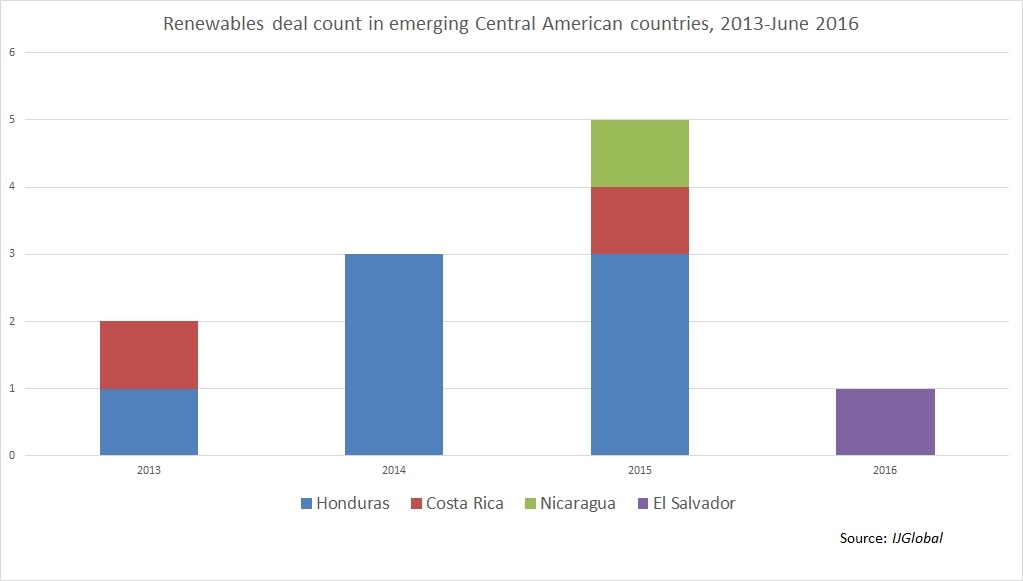

According to IJGlobal’s sample data, Honduras has accounted for seven of a total 11 closed renewable energy deals in Central America’s emerging markets since 2013. These comprise five photovoltaic (PV) deals, one wind and a small hydro transaction.

Honduras’ state-owned power utility, Empresa Nacional de Energía Eléctrica (Enee), has ramped up the procurement of 20-year power purchase agreements (PPAs) to private sector developers in recent years to encourage investment into renewables.

After introducing an incentive scheme in 2013 (which promised a premium tariff for the first 300MW of projects to come online in mid-2015), Honduras saw two deals close a combined $200 million debt in 2014 and three projects sign on $261 million in debt the following year.

According to IJGlobal data, SunEdison’s $146 million debt financing backing the 81.7MW Pacífico PV complex closed in 2014 is the largest transaction to close to date in support of a Honduran solar project. The loans – provided by CABEI, IFC and OPEC – will back the development of three PV facilities located in in the southern region of Choluteca. The Multilateral Investment Guarantee Agency (Miga) subsequently provided an investment guarantee for the project.

The next largest transaction by this measure was a $116 million debt facility closed in 2015 in support of Mexican developer Gauss Energia’s 61MW Aura solar II facility. The deal drew three lenders; Mexican export credit agency Bancomext, Germany’s DEG and IFC.

Scatec solar and Norfund also closed a sizeable $90 million debt facility in 2015 with Export Credit Norway (Eksportfinans), the Norwegian Export Credit Guarantee Agency (GIEK) and the Inter-American Investment Corporation (CIFI) to develop the 60MW Agua Fria PV project.

According to Enee, 389MW of new solar capacity came online during 2015, which represents a portion of a total 620MW which had been authorised by the National Congress slated to enter operation by the end of 2016.

Solar is gaining momentum elsewhere in the Central American region. Mexico held its first power auction for long-term PPAs in March 2016 in which it awarded almost 1.7GW of PV contracts. Prior to this, only two utility-scale PV projects had reached financial close in the country.

El Salvador is due to hold its next renewable energy auction in the second half of 2016. The country held its first such tender in 2014 to contract 100MW of wind and solar capacity, but after receiving solely PV bids, the government awarded contracts for 98MW of solar capacity.

In June 2016 French renewables developer Neoen and local partner Almaval signed $117.7 million in loans for the Providencia Solar project, slated to be El Salvador's first-ever utility-scale PV project. The IIC and Proparco were lenders of record.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.