A model for Cuban investment

A historic thaw in US-Cuba relations has prompted growing interest among international investors in Cuba’s liberalising and underdeveloped economy. Potential investment opportunities in the energy and infrastructure sectors are vast, following decades of neglect.

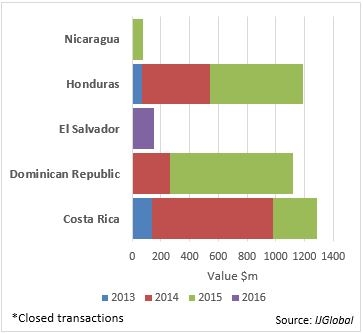

Although historically and culturally unique, Cuba is not the only country to have attempted to attract private investment into the region in recent years. Of the emerging Caribbean and Central American countries highlighted below, Costa Rica has been the most successful at closing deals according to the IJGlobal database, but El Salvador is the only one to have closed a transaction so far this year.

Honduras and El Salvador have held recent renewables tenders, in which contracts have been won by local, regional, and international developers.

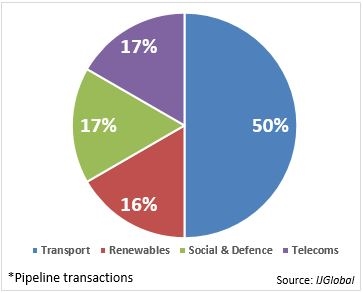

While there is significant potential for renewables investment, transport represents half of the pipeline, and is technically and financially more difficult to deliver. Of the closed deals in IJGlobal’s sample data just three are transportation projects, two of which were in Honduras and one in Costa Rica.

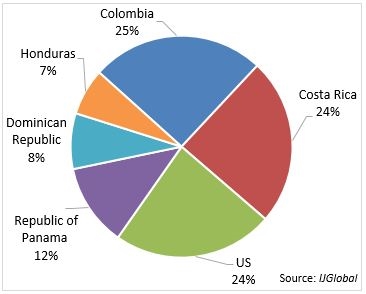

Local lenders have contributed around half of the debt for the closed projects. Multilaterals such as the Central American Bank for Economic Integration (CABEI), the Inter-American Corporation for Infrastructure Finance (CIFI), US Exim, FMO, Proparco, and IFC have also been particularly active in the region.

Attracting international investment will be essential for Cuba. US and regionally strong banks from countries such as Colombia and Costa Rica are the lenders likely to support its deals.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.