Data Analysis: AIIB's push into Pakistan

The new China-backed Asian Infrastructure Investment Bank (AIIB) has selected a Pakistan project for its first ever loan. AIIB is to co-finance construction of a 64km portion of a highway in Punjab province alongside the Asian Development Bank. The loan is part of a wider trend of Chinese investment into the country.

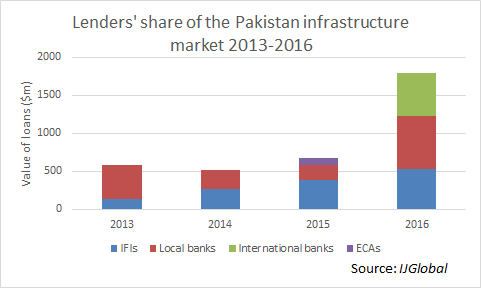

Pakistan has a significant infrastructure gap, with State Bank of Pakistan claiming the country needs to invest around 10% of its GDP into the sector annually until 2020. Local banks have been the most frequent lenders in domestic infrastructure in recent years, providing 63% of all loans. The local banking market is certainly liquid, with up to $7 billion of deposits available for investment according to some estimates. And these banks have a long history of supporting domestic power projects with debt of up to 12 years.

But the average debt tickets provided by these institutions are much smaller than those of development banks and other international finance institutions (IFIs). By total value of debt, IFIs take a similar slice of the lending market to local banks, and the value of their lending has increased each year since 2013.

The roughly $2 billion financing of the Thar coal mine and power plant, concluded in February this year, may set a precedent. A group of 10 local banks provided $705 million, while $821 million came from the China Development Bank and two Chinese commercial banks.

If Pakistan can begin to procure more transport and social infrastructure projects, for which local banks have less experience, the AIIB may find plenty more opportunities to lend.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.