Data Analysis: Pakistan's pipeline

As Pakistan prepares to end its status as a ward of the International Monetary Fund and boost infrastructure spending, IJGlobal data reveals that the number of infrastructure projects launched in the country has been growing.

Nawaz Sharif’s Pakistan Muslim League was returned to power in Pakistan in 2013 on a platform to end the country’s electricity crisis.The country suffers a 5,000MW per hour shortage and regular blackouts. Around a quarter of the country is not hooked up to a grid and remains un-electrified.

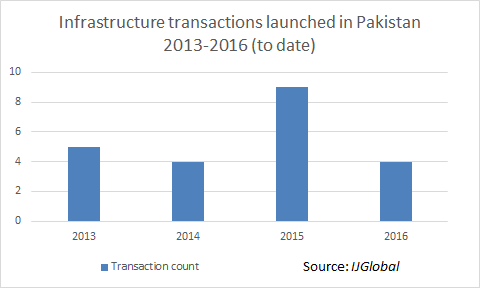

The government has looked to procure major power plants and associated projects to remedy this and other infrastructure issues. As IJGlobal data shows, there were four infrastructure projects launched in the country in 2014 and a further nine in 2015.

Already home to two of the largest dams in the world, Pakistan is continuing to focus on building new dams not only for power production but also to control water shortages as well as provide flood protection.

In its most recent budget for the fiscal year starting July 2016, the government allocated PRs74 billion ($707 million) for the Diamer Bhasha and Dasu dams.

The 4,320MW Dasu Dam, backed by the World Bank, is the country’s biggest active infrastructure project, according to IJGlobal data. The World Bank signed its $584.4 million 25-year loan and a $460 million and IDA credit partial guarantee for the first $2.58 billion 2,160MW phase of the Dasu Dam in August 2014 . China’s ICBC, backed by China Exim Bank, is providing the bulk of the financing for the project via a $2 billion loan.

Another development is the China-backed drive to boost coal power generation. This February, China Machinery Engineering and its partners reached financial close on the first phase of the $2.02 billion Thar Coal mine and power plant project. The deal is Pakistan’s second largest power project over the past five years, according to IJGlobal data.

Spending on the future

The latest government budget, unveiled last week, confirms the government’s commitment to end the chronic electricity shortages. Finance Minister Ishaq Dar increased the budget for infrastructure spending by 15% for the upcoming fiscal year, to PRs468 billion. The Water and Power Development Authority and the National Transmission and Despatch Company will be spending another PRs250 billion.

The government is also hoping infrastructure spending will spur economic growth and decrease employment. Dar is aiming for an ambitious GDP growth rate of 5.7% for the year ending June 2017. The Asian Development Bank’s forecast for 2016 and 2017 is 4.5% and 4.8%, respectively.

The efforts appear to be paying off. Over the past year, electricity generation and distribution has grown by 12.18% and the construction sector has expanded by 13.1%, according to a KPMG report.

Bulging pipeline

Pakistan’s demand for electricity is projected to grow by between 2-3% a year and with the government looking to plug at least some of the short fall, the country looks set for a major power generation building spree.

Around 23,000 to 24,000MW, or six to seven coal fired power plants are in the pipeline, which will raise the proportion of coal fired power from the current 1% to between 10% and 20% of total generation capacity. In addition, around 3,600MW of additional LNG power plants, as well as 1,000MW of wind and 5,000MW solar are expected to be built over the next several years.

The other big ticket sector, which is also backed by Beijing, is a push to upgrade and build new roads across Pakistan, particularly between the main commercial port Karachi in the South and the border with China in the north. The promises have been large: Beijing has pledged $45 billion to the so-called China Pakistan Economic Corridor, an extension to China’s 21st century Silk Road initiative.

The biggest of them, at least for now, is the $7 billion 1,152km Karachi-Lahore Motorway. China Railway Construction, along with local partners Zahir Khan and Brothers Engineers and Constructors won the bid last December.

Beijing’s largesse may be putting Pakistan in an enviable position but the country may not be able to absorb all the funding. “Pakistan can probably only manage to spend around half of the $45 billion over the next five to seven years,” one Pakistan source told IJGlobal.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.