Data Analysis: Record levels of Chinese acquisitions in Europe

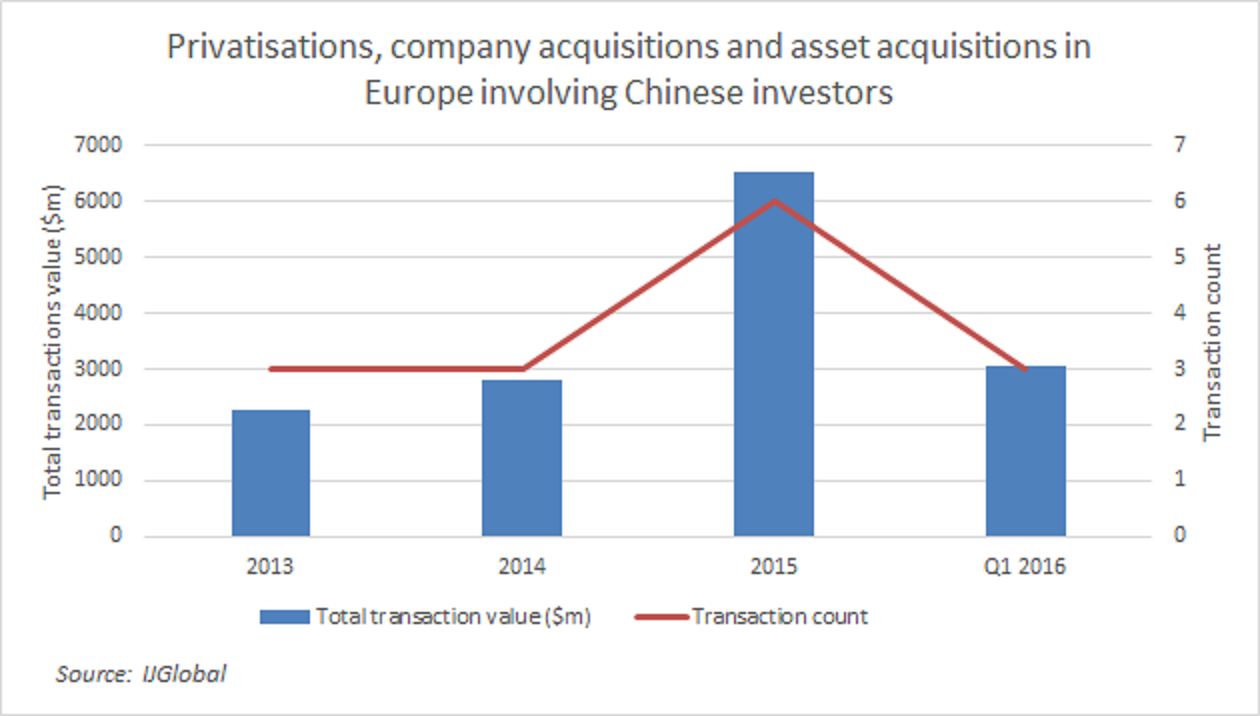

Some of the largest infrastructure and energy acquisitions in 2015 and 2016 in Europe have featured Chinese companies, bidding alone or as part of a consortia. With only one quarter of data to go by, 2016 is likely the strongest year yet for Chinese acquisitions in Europe.

According to IJGlobal data, the total value of acquisitions and privatisations in all infrastructure and energy sectors for Q1 2016 was $3.05 billion. The quarter total has already reached a level equivalent to 46.6% of the full year value for 2015 ($6.54 billion).

The three deals closed in 2016 so far include the state-owned Beijing Enterprises $1.58 billion acquisition of EEW, a German energy-to-waste company. The deal was the largest ever Chinese direct investment into a German company. Also in 2016 there has been China Silk Road Fund’s $1.2 billion acquisition of 9.9% of the Yamal Liquefied Natural Gas project in Russia, and State Development & Investment Corporation’s acquisition of Repsol Nuevas Energias UK for $266.7 million.

In 2015 Chinese investors were involved in six acquisitions in Italy, France, UK, Spain, Turkey and Russia.

A growing pool of investors

Growth in China has been steadily slowing down. According to Trading Economics, the Chinese economy in Q1 2016 experienced 6.7% GDP growth, its weakest level of first-quarter GDP growth since 2009, while 2015 GDP growth of 6.9% was the weakest figure since 1990. The World Bank forecasts steady drops from 6.7% (2016), to 6.5% (2017) and 6.3% (2018).

Gingko Tree, an investment fund owned by China’s State Administration of Foreign Exchange, has been active in Europe for around three years. Private company Cheung Kong Holdings (CKI) from Hong Kong has likewise been bidding on assets for several years now in Europe.

A contact at a Spanish bank said they are being approached more regularly this year than before by Chinese investors for deals. They added, “Chinese investors can see their own market has been becoming quite overheated and are looking abroad to diversify, much like Japanese investors did in the late 1990s.”

An adviser at an investment bank advising several Chinese companies told IJGlobal, “There is new money coming [here] from State Grid Corporation of China and Beijing Enterprises. These state-owned companies are making a big push for outbound investment.”

Acquisitions since 2013 have also featured China Three Gorges, Far Eastern Shipping Company, China National Petroleum Corporation, Solar Power Inc., Friedmann Pacific, Shandong Hi-Speed Group, China Merchants Holding, China Investment Corporation (CIC) and Trina Solar.

2016 pipeline

Several acquisitions are lined up with Chinese companies holding preferred bidder positions. This is the case for Flemish electricity and natural gas grid operator Eandis, for Frankfurt-Hahn Airport, for EDP’s Polish and Italian wind portfolio and for concession companies for Tirana International Airport in Albania and Piraeus Port in Greece.

There is no guarantee these auctions will be won by consortia feature Chinese investors however, and Chinese investors have missed out of some big transactions in recent years.

Sovereign wealth fund CIC bid unsuccessfully to buy German service station company Tank & Rast last year, and is now part of a consortium preparing for bidding on the National Grid’s UK gas distribution network sale when it launches next month.

London City Airport’s sale was one of the most competitive recent M&A deals for a large core infrastructure asset. In February 2016 a group of Canadian and Kuwaiti funds won the bidding, though two Chinese companies were the competitors - HNA Group and CKI. IJGlobal understands from a source who worked on this deal that the least experienced bidder, HNA, bid the highest price by a long way in its final offer, but with the condition the airport must achieve planning approval for its politically contested extension, a condition the other bidders did not enforce.

The earlier mentioned investment bank adviser concurred. “Getting certainty in their bid can be the challenge [for Chinese investors], due to lack of experience.”

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.